30.07.2025 / 08:30

An Innovative Platform for the Future of SustainabIe Investments

Financial Markets

FORRS Interview with Greenium

Greenium connects institutional investors with sustainable real-world assets through an innovative and transparent platform. By combining Securitization-as-a-Service, customizable real-time reporting, and optional asset tokenization, the company offers a modern infrastructure for financing the next generation of ESG-compliant investments.

FORRS: What is Greenium and what do you do?

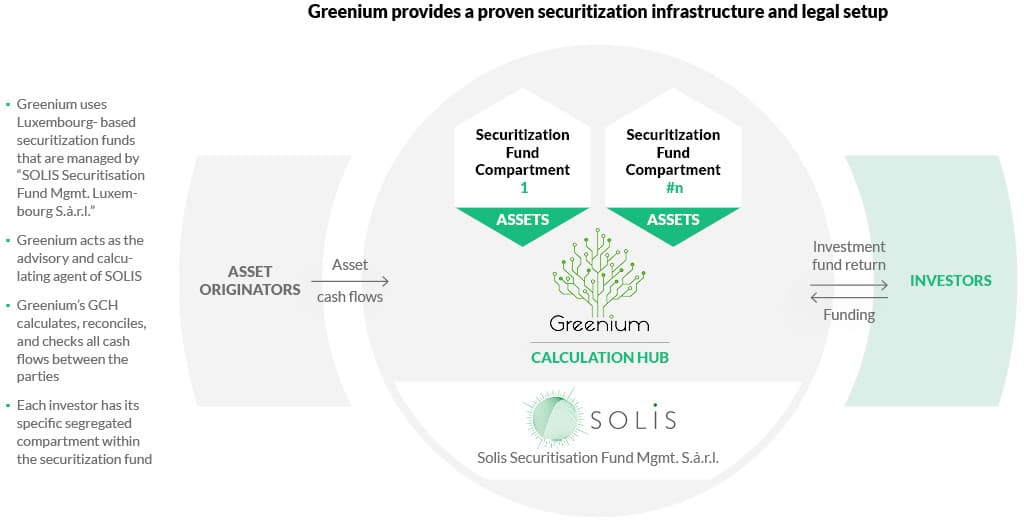

Luc Olinger: Greenium is essentially a bridge. We connect institutional investors with physical sustainable assets, like corporate bike leasing portfolios, solar parks, or battery storage systems. Our platform, the Greenium Calculation Hub, manages and structures the financing of these assets through Luxembourg-based securitization funds. It may sound technical, but the core idea is simple: We turn sustainable assets into transparent and investable financial products by securitizing the associated cash-flows. We call it “Securitization-as-a-Service”.

FORRS: Why did you start Greenium?

Luc Olinger: The idea came from a very practical need: financing corporate leasing bikes. We realized there was a big demand for scalable, alternative financing solutions for sustainable assets, especially outside of traditional banking structures. At the same time, we saw that institutional investors were looking for ways to access these asset classes without getting bogged down in regulatory red tape and due diligence requirements typically associated with AIFs (Alternative Investment Funds). That is how Greenium was born.

FORRS: Who are your typical clients?

Luc Olinger: We serve two sides. On the one hand, we work with originators – companies that build, develop, or operate sustainable assets. These can be leasing companies, project developers, or infrastructure operators. On the other hand, we work with institutional investors like insurance companies, pension funds, and asset managers looking for ESG-compliant but professionally structured investments.

FORRS: Were there any key turning points when you realized your product was working?

Luc Olinger: Definitely. One big milestone was working with Bike Leasing Group. When we successfully structured and refinanced a €100 million portfolio with full transparency and minimal friction, we knew the model worked. More originators reached out soon after, confirming the market need.

FORRS: How do you see the market evolving? Are there trends making Greenium more relevant?

Luc Olinger: Absolutely! Two trends are working in our favor. First, there is growing pressure on institutional investors to make their portfolios truly sustainable – not just on paper, but in real-world impact. Second, there’s a clear move toward more transparency and digitization in investment products. That’s exactly where our platform and real-time reporting come into play.

FORRS: Can you tell us about Greenium’s history and key milestones?

Luc Olinger: We launched Greenium at the end of 2021, initially focusing on Bike Leasing Group. Structuring that first major transaction gave us the foundation to scale the model. We then expanded the platform, added new asset classes, and built a strong investor network. A key milestone was integrating an optional tokenization Distributed Ledger Technology (DLT) – enabling us to potentially issue digital securities in line with eWPG regulations down the line.

FORRS: How do you differ from traditional ESG-AIFM funds?

Luc Olinger: That is a great question. It really highlights our unique approach. Traditional ESG AIFs often come with regulatory complexity, long due diligence processes, and limited structuring flexibility. We intentionally built Greenium outside that framework. Our Luxembourg securitization funds are not AIFs, so they do not fall under the AIFMD regime. For investors – especially insurers and pension funds – this means less regulatory friction, faster investment processes, and better portfolio compatibility. Plus, our platform offers deep, real-time, customizable reporting. And we think digitally from the ground up. You do not get that combination of flexibility, transparency, and digital readiness in most traditional ESG funds.

FORRS: How do you see digitalization – such as tokenization and real-time reporting – in the evolution of sustainable finance, and how is Greenium positioned to lead in this space?

Luc Olinger: Digitalization is key to scaling sustainable finance. With our Greenium Calculation Hub, we offer real-time, customizable reporting that meets institutional expectations for transparency and compliance. Tokenization adds further value – enabling faster settlement, broader access, and future-ready infrastructure through digital securities aligned with eWPG standards.

FORRS: What are your plans for the future?

Luc Olinger: We aim to expand into more sustainable asset classes – like solar, charging infrastructure, and industrial energy/battery storage. At the same time, we are pushing to internationalize the platform and make investment access even easier and more flexible – for example, through standardized, digitally accessible product structures.