01.07.2025 / 08:30

Market Trends

Energy Markets

Every challenge comes with an opportunity. And utilizing opportunities requires the ability to change. Nearly all participants in energy markets are facing changes, often resulting in larger-scale transformation projects. The right technology and architecture as a foundation for energy trading are key enablers for changes.

The challenge

The global push for a net zero economy is the core driver for rapid changes all over the planet and throughout all energy companies. The massive expansion of decentralized and inflexible generation from renewables is a huge opportunity, but at the same time creates high complexity, for example, due to a large resulting lack of generation flexibility impacting entire power systems. All this requires a pressing need for fast changes. Automation, resilience, and speed are all paramount for energy trading organizations to cope with these challenges. Geopolitical instabilities drive insecurity and complexity further, especially on the supply side, such that governments globally put security of energy supply on their national security agendas. The resulting price spikes and massively increasing volatility has placed significant pressure on trading organizations globally.

Along with the transition to a net zero economy and geopolitical instabilities, ongoing power market liberalizations and market integration through market coupling across Europe increase the complexity for energy trading organizations. At the same time, those developments also provide new opportunities. Screening and forerunning the market together with innovation are crucial ingredients to identify and leverage those opportunities.

On the one hand, energy trading organizations must heavily increase their sophistication levels in existing fields of business, but must also establish new business models to generate new profits. The journey towards 2030 and beyond is a pathway driven by organizational, operational, and especially technological changes for all companies and their associated businesses. How we generate, manage, and consume energy is undergoing a significant transformation.

Energy companies are facing massive transformation journeys already today. Moreover, the demand for even faster changes towards a future proven infrastructure is heating up. Not every organization starts at the same level and with the same business models, resources, and skills. There is no “one-size-fits-all” approach for shifting trading organizations towards their future targets.

The shift

Energy companies are exposed to manifold challenges, driven and enabled by current and future technologies. The selection and integration of the right technologies has become a core strategic matter and is no longer optional. Choosing the right technology stack will become even more important in the future, given the foreseeable challenges.

In past years organizations learned to build technology within projects and to operate applications daily. Now, the main shift is to transform towards an assembly organization, where adoptions to data, models, and processes are continuously integrated without losing consistency, correctness, timeliness, or other measurable key performance indicators (KPIs).

Quants are building better models every day, improved generation forecasts are provided constantly, and new assets, deals or counterparties are onboarded continuously. Given the high volatility, risks must be evaluated, not at only end-of-day, but at intraday/near-real time, to ensure staying within given risk policies and to have sufficient liquidity.

At this time, the industry is moving from a price taker to a risk taker trading approach. The same development was seen in the banking world years ago. For example, real-time position and risk views are required to avoid losses and imbalance fees in physical short-term markets. This development towards a real-time and event-driven architecture can only be achieved with the right technology choice as a foundation.

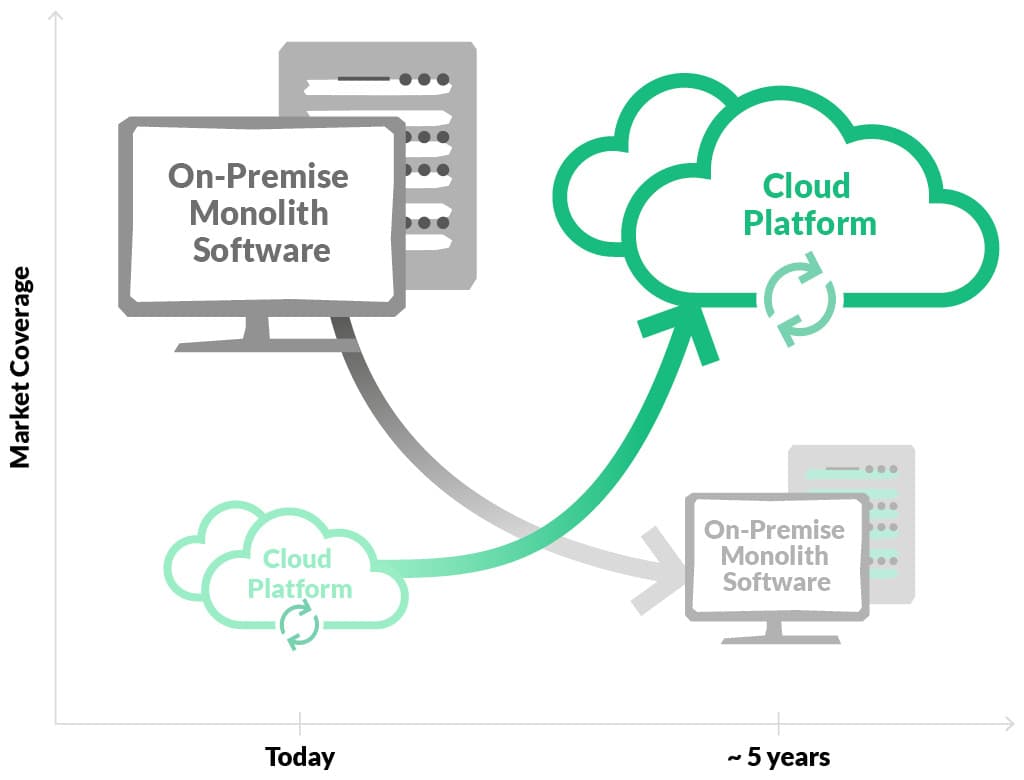

Trading organizations are moving from on-premise monolithic ETRM setups to a microservice-based ETRM strategy.

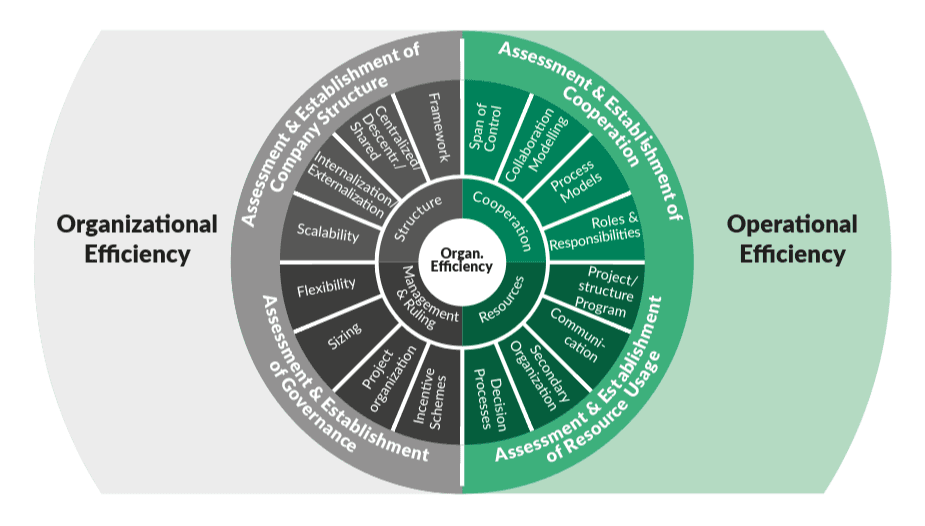

The right technology choices and a flexible architecture are the backbone of organizational and operational efficiency.

The competitive edge

For a long time, technology has been a decisive factor. Better technology forms better energy organizations. This competitive edge is shifting. Choosing the right technology and adopting it fast is more a survival factor than a “best of breed” factor. Technology is the backbone of automation and fast decision making. And faster time-to-market typically creates more revenue and profits.

Implementing the shift

Future energy organizations will be much more resilient and constructed from an operations perspective. The core questions will be “can we safely operate it? If not, when will we be able to?” or “if our software infrastructure has an outage, what do we do, and when are we back online?” Organizations and their technology architectures become more of an integrated platform than an application landscape consisting of monolithic applications. Speed and the ability to integrate new data, models, or processes are the leading factors, rather than having the one and only required feature. The clear trend in the market is to move away from monolithic systems architectures toward adoptable and flexible cloud-based platforms solutions.

Business continuity and resilience are the core KPIs and guide the roadmaps of organizations.

A new solutions era

Designing a future technology and software landscape for an energy trading company always comes back to the fundamental question – “brown field or green field?” This means “shall we start from nothing and build everything new (‘green field’), or should we rebuild the existing environment efficiently (‘brown field’) to deliver all capabilities for a future proven trading landscape?” Again, the right technology choice is the backbone for organizational and operational efficiency.

Conclusion

Major paramount capabilities of a future trading landscape in energy trading are outlined in this FORRSight magazine, to guide you through your decision processes and solutions design initiatives.