08.07.2025 / 08:30

Algo Trading and Algo Architectures

Energy Markets

Algorithmic energy trading is rapidly evolving. The energy transition boosts renewables and flexible assets, such as Battery Energy Storage Systems (BESS), while its increased volatility attracts diverse traders. Discover what is essential to stay competitive in the face of these challenges.

The presence of algorithms in both short- and long-term markets is increasing year by year, with more and more electronic orders being placed in order books. The growing penetration of renewables has further shaped the market dynamics that make algo trading indispensable. The pan-European market coupling for cross-border trading further increases opportunities for algo trading by increasing liquidity.

Beyond the management of renewables in physical short-term markets, more utilities and trading firms are establishing rule-based algos for speculative trading strategies in short-term and also liquid long-term/forward markets (“trading the curve”). Though yet less developed, the application of machine learning and artificial intelligence is another clear trend, and is typically used to identify trading signals in short-term markets, based on the most recent price and power generation forecasts.

However, the primary focus for algo trading continues to be on short-term markets, where algorithms are crucial in continuous trading for managing flexible and inflexible assets, such as renewables. No matter the underlying purpose, a sophisticated and resilient algo framework is crucial for building up a scalable and profitable algo trading.

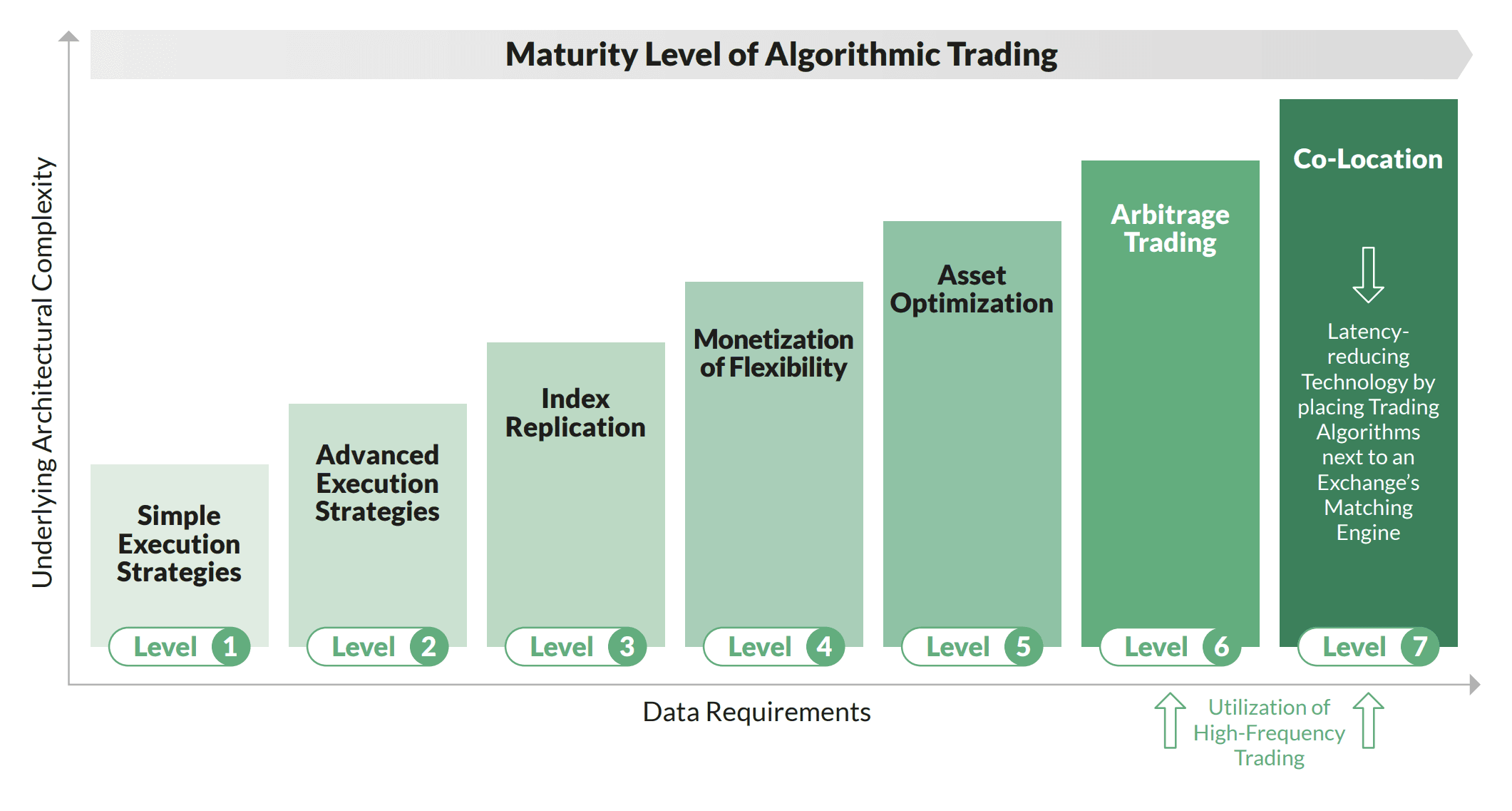

The FORRS maturity model: target use cases define the starting point for algo trading

The algo framework and underlying architecture must support the intended use case for algo trading. For example, closing open intraday positions from inflexible renewables in continuous power markets requires a different underlying architecture than optimizing BESS or flexible generators across several markets, such as long-term, short-term, and reserve markets. Therefore, it is important to first define the use case and related functional requirements. From there, the technical requirements for the architecture can be derived, including the technology stack, systems, or interfaces. Our experience shows that building algo strategies without designing a fit-for-purpose algo framework and architecture as a scalable technical foundation first will create huge complexity and costs later, to correct the technical components that have been built out.

At FORRS, we have developed a Maturity Model for algo trading (see below) to make identifying the target use case easier than ever. Depending on the target use cases, we are deriving the underlying functional requirements, along with the technical requirements towards the architecture. For example, a “smart iceberg” strategy for position closing implies fewer complex requirements than developing a front-to-end algo strategy for asset optimization, such as a gas-fired power plant or a gas storage facility

The FORRS maturity model for algo trading is a structured approach towards establishing a resilient and scalable framework for algo strategy development

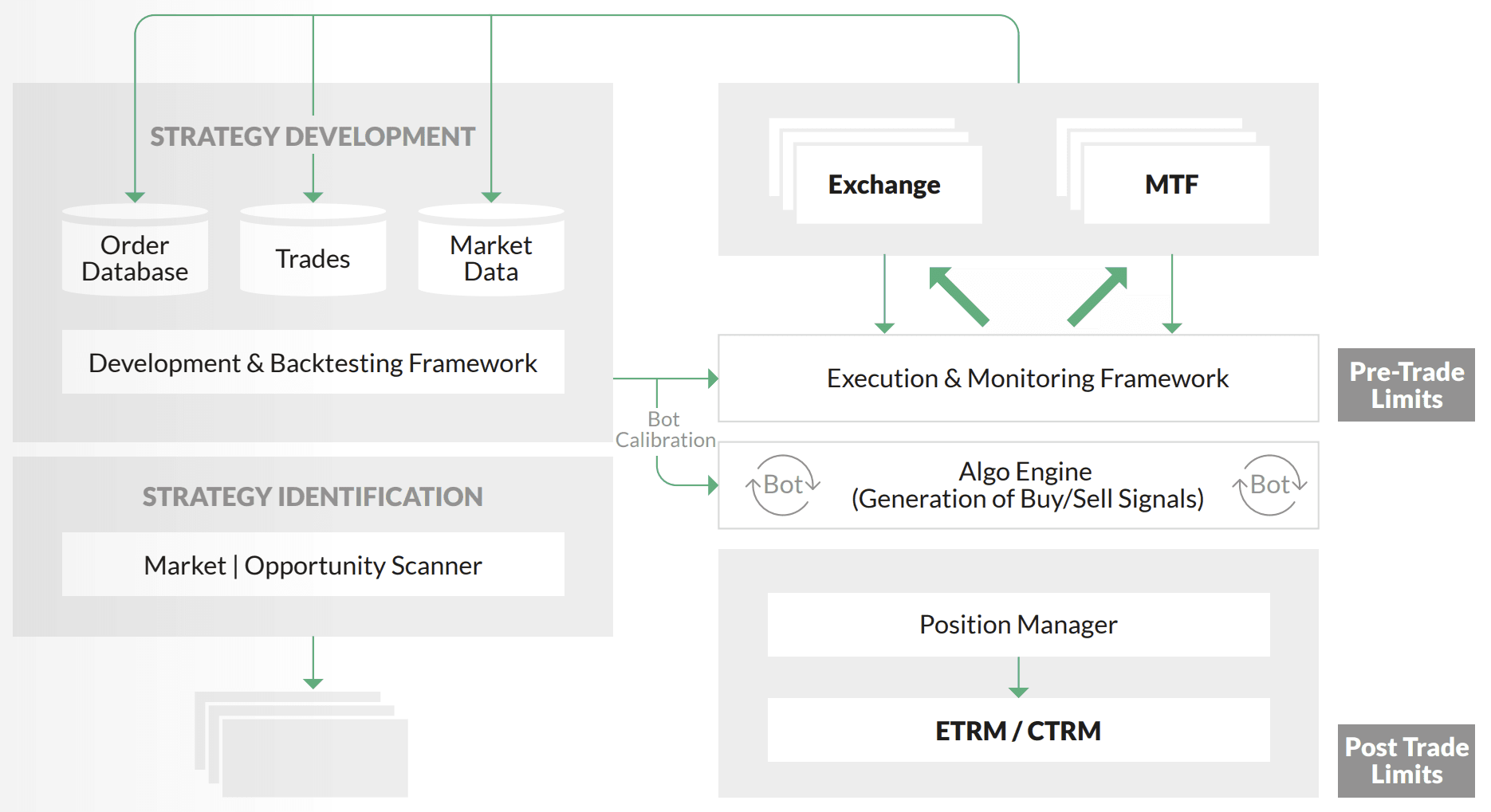

Developing algo strategies requires an integrated framework based on a robust state-of-the-art architecture and technology components

Algo trading requires an integrated framework for short time-to-market

Once the target use cases for algo trading have been defined, a fit-for-purpose architecture, including technology selection, should be derived, to build up a robust and extendible algo framework. We will dive into the most important framework components in the following.

To ensure that algo strategies can be implemented on a common and maintainable code base, a robust and scalable development framework, based on continuous integration and continuous development (CI/CD) principles, is required. This ensures that developing and maintaining strategies can be scaled simultaneously across several persons and teams. In addition, it allows for continuous integration of new strategies into production quickly, to speed up time-to-market. algo framework is crucial for building up a scalable and profitable algo trading.

A backtesting framework ensures that strategies can be thoroughly tested before deploying them into production, ideally based on historical order book data. This requires a sophisticated data management framework as a backbone, granting access to historical data in a normalized and fast way. The developed, tested, and calibrated algo must then be integrated into the algo engine to generate buy and sell signals. To act on these signals, a comprehensive execution and monitoring framework is essential to translate them into orders on exchanges and multilateral trading facilities (MTFs).

Conclusion

Developing algos in a sustainable and scalable manner does not start with coding. We can clearly see that utilities and energy trading companies think about algo trading in a holistic way, where designing a robust and extendable algo framework and underlying architecture is a key component, and often the first step before coding algos.