23.07.2025 / 08:30

Liquidity Categories, Market Participants and Impact on Price Discovery

Financial Markets

Liquidity is a fundamental value driver for all marketplaces. In EUR equity markets, it is a main driver of execution efficiency up to price discovery. But how does liquidity differ across various liquidity categories? What are the trends and what impact do they have on price formation?

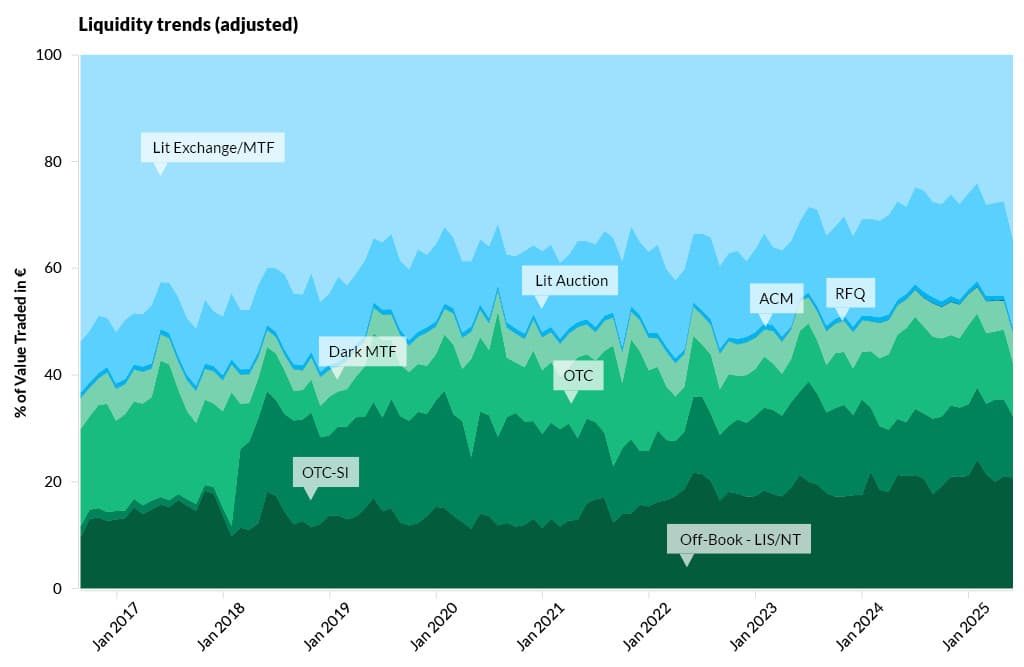

Let’s consider the European equity markets. The chart on next page illustrates the reported share of equity transactions by liquidity category, based on the average daily traded volume of approximately 140 billion Euros in March 2025. However, these reported figures may be inflated, due to double counting or other data quality issues. The company big xyt, known for high-quality data analytics, offers an adjusted figure of 127 billion Euros in average traded volume, on a daily basis. They evaluate the OTC/SI data differently (the plot also uses adjusted volumes).

We observe that Lit Auctions have been gaining market share. Lit limit order book trading has been declining, while Dark Pools have remained stable in recent years. However, OTC and Off-Book volumes appear to be growing, suggesting that traditional trading venues may not be fully meeting the liquidity demands of the market participants.

Lit Exchanges

A Lit Exchange/MTF (Multilateral Trading Facility) is a fully transparent trading platform where buy and sell orders are visible in a public order book. These markets offer the highest level of price discovery – buyers and sellers agreeing on the current value of a financial asset - as participants can see bids and offers in real-time.

Key participants include retail brokers, institutional investors, high-frequency traders (HFTs), and market makers. However, executing large transactions in this market can be costly, as the liquidity premium is comparatively high for this type of deal. Institutional investors often seek alternative venues, to minimize total transaction costs for large transactions.

Lit Auctions

Lit Auctions are scheduled trading events, such as opening and closing auctions. Their asset prices are based on accumulated buy and sell offers collected over the time horizon since the last auction. Compared to Lit Exchanges, the main effect of Lit Auctions is to reduce volatility, as deals are not executed immediately, thereby establishing a fair market price at key moments during the trading session. The primary participants include institutional investors, retail brokers, and arbitrageurs. Since auctions aggregate demand and supply, they play a critical role in price formation as most market participants consider closing auction prices to be reliable indicators of fair market value.

The rising popularity of ETFs has increased liquidity needs for institutional investors, since there are rebalancing days for each ETF. Also, some institutional investors prefer participating in end-of-day auctions, as these prices are typically used for calculating the net asset value (NAV) in their performance reporting. As a result, a significant portion of institutional trading volume is executed during closing Lit Auctions.

Dark Pools / dark MTFs

Dark Pools are non-displayed order books, where large trades, often executed at the mid-price, occur without pre-trade transparency. These markets allow institutions to execute large trades without causing price movements in Lit Markets. The primary participants include institutional investors, hedge funds, and liquidity providers.

Since Dark Pools reference prices from Lit Markets, rather than establishing new ones, their contribution to price discovery is limited. Their market share has remained relatively stable, emphasizing their role as a reliable source of liquidity for (large) trades. The double volume cap mechanism under MiFID II limits the maximum trading volume in dark pools and other non-transparent trading venues in the EU.

OTC markets

OTC trading involves the direct exchange of financial instruments between counterparties without using a centralized exchange. Common participants include corporations, hedge funds, and banks. Since OTC markets lack a centralized order book, price discovery in these markets is weaker than in lit exchanges.

OTC systematic internalizers

OTC Systematic Internalizers (OTC-SIs) are investment firms or banks that execute client orders on their own account, rather than routing them through an exchange. Participants include banks, broker-dealers, high-net-worth clients, and institutional investors. These firms often provide liquidity based on internal pricing models that reference exchange prices. As a result, their contribution to price discovery is minimal.

Off-Book transactions

Off-Book transactions occur outside exchanges and qualify as large-in-scale (LIS) or negotiated trades (NT), thereby reducing market impact. Institutional investors, investment banks, and pension funds frequently engage in Off-Book trades to execute large transactions efficiently. Since these trades are privately negotiated, they do not always reflect real-time supply and demand, limiting their influence on price discovery.

The high market share in Off-Book and OTC transactions suggests that broker-dealers and banks can offer highly competitive prices for large transactions. As a result, exchanges and MTFs can struggle to satisfy the extraordinary liquidity demands of market participants.

Alternative closing mechanism and requests for quote mechanism

The market share of Alternative Closing Mechanism (ACM) and Request for Quote (RFQ) mechanism remain negligible, and don’t contribute to market liquidity.

Liquidity trends (adjusted). The data presented in this figure is proprietary to big xyt. Any further use, reproduction, or distribution of this data requires explicit permission from the data provider.