09.07.2025 / 08:30

The Challenge of PPA Integration

Energy Markets

PPAs: key to the renewable energy market

Power Purchase Agreements (PPAs) are non-standard, long-term contracts between energy producers and consumers or intermediaries. These contracts are aimed at providing a framework for purchasing electricity, typically from renewable sources, such as wind or solar. In Europe, PPAs have recently gained significant traction due to climate goals and rising demand for renewable energy, alongside a reduction in subsidies for renewables.

PPAs address a number of key market needs. They offer energy producers financial certainty to invest in new renewable projects, while offering consumers – particularly corporations – stable and often low-cost energy prices, to help meet sustainability targets. The growth of PPAs is further driven by the increasing volatility of wholesale energy markets and the EU’s push for decarbonization, making PPAs a crucial tool in the energy transition. In this context, PPAs also allow easier access to wholesale energy markets for especially smaller-sized developers of renewable generation.

What makes PPAs unique?

Mastering the full trade lifecycle is key for every energy trading organization. Most players handle this with ease, but PPAs often diverge from standard products, demanding adjustments within the existing trading landscape.

Let us navigate through the PPA deal lifecycle, focusing on its uniqueness and challenges.

The PPA deal lifecycle: The complexity of PPA contracts requires extending standard deal lifecycles across the entire trading landscape.

The first step is to define a PPA strategy and an underlying business case. This can involve making an existing power portfolio greener, providing industrial customers with green electricity, or generating profits by being a PPA risk taker.

The next step is to specify a PPA product structure – whether solar or wind, physical or financial, indexed or fixed price, or fixed vs. floating volume. Each variation comes with distinct downstream process challenges.

Once the strategy is clear, market readiness must be assessed. Key considerations include legal and regulatory obligations, access to wholesale energy markets, and creating an account in the guarantees of origin register. Standardized term sheets and contracts are critical to swiftly secure PPA deals, as market volatility often results in short binding periods.

Once potential deals are identified, the pricing and negotiation phase begins, including a thorough risk analysis. A PPA pricing and risk model or platform must be flexible to cope with different risks implied in PPA structures and with diverse data sources and qualities.

If the negotiations succeed and a contract is signed, long-term PPA portfolio management follows. The PPA portfolio management cycle includes valuation and risk management, position management, hedging strategies execution, End-of-Day reporting, and more.

Throughout this cycle, accurately measuring the risks of PPAs and hedges is crucial for making optimal use of risk capital and sound hedging decisions.

As physical delivery approaches, organizations must establish a fast and resilient short-term portfolio management for PPAs with physical delivery. Unlike earlier stages, this step requires 24/7 monitoring and trading systems to address immediate operational needs.

The final step – settlement and invoicing – requires robust processes. Common pitfalls include data gaps, contract specificity, or evolving regulations like Redispatch 2.0 in Germany. Errors here can harm profitability and customer satisfaction. Since PPAs fall under REMIT reporting obligations, required systems and processes must be available.

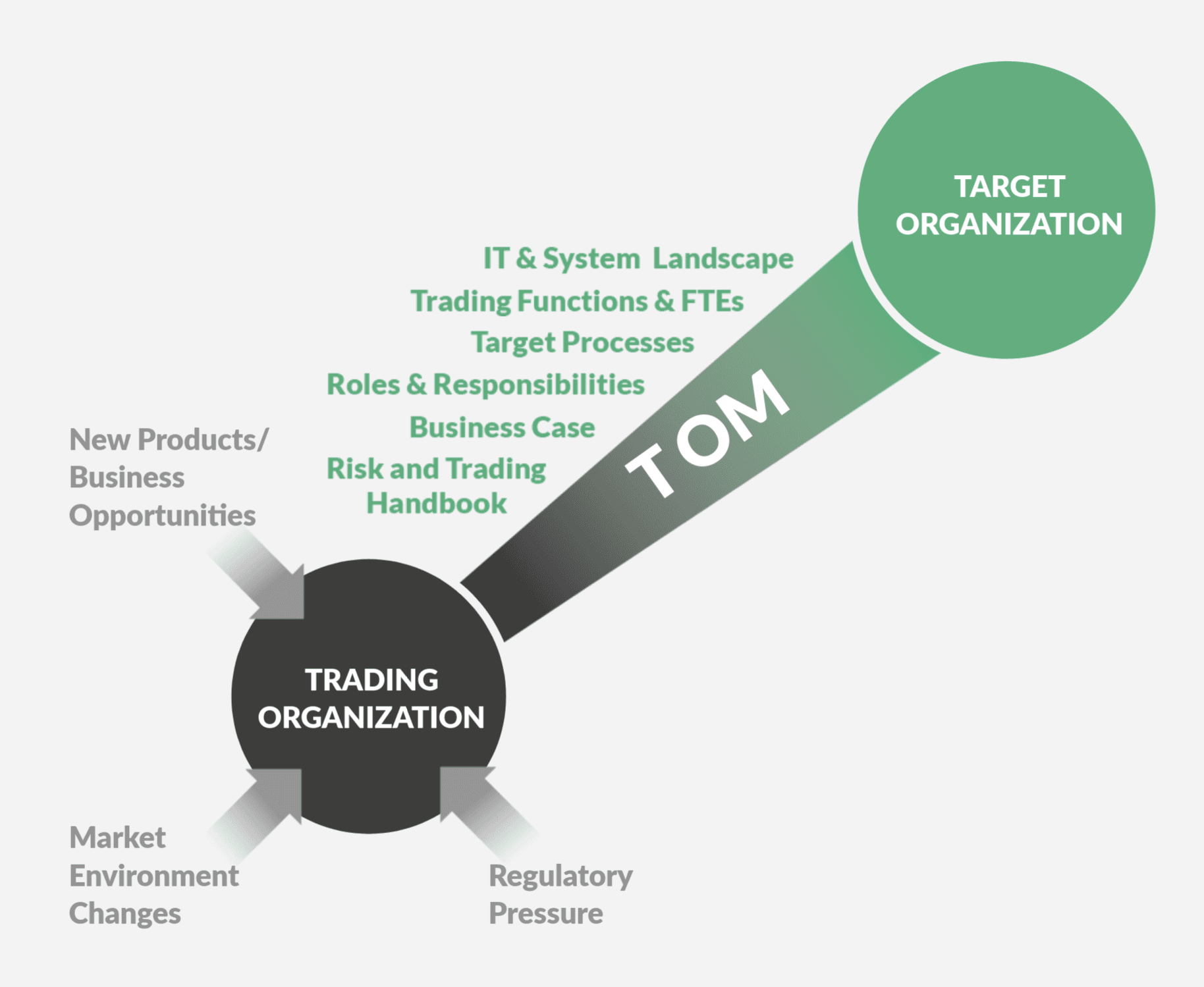

In conclusion, PPAs demand significant adaptations across an organization’s systems and processes. See our approach to develop a Target Operating Model (TOM) on the right to learn how we at FORRS can make your trading organization ready for PPAs.

FORRS’s experience after the first implementation waves / target operating model (TOM)

Transformation as process: PPAs require a transformation of many areas within energy trading organizations. Where are you on that journey today?

Integrating PPAs affects the entire trading organization. While all departments are involved, their interests and profit contributions often vary, leading to unclear profit-sharing arrangements and lengthy disputes.

Moreover, effective PPA data management is critical for PPA success. Many organizations struggle with complexities of PPA data, requiring adjustments to their IT and organizational structures. But how can organizations transform to handle PPAs efficiently?

At FORRS, we have established an approach for developing a TOM, which has proven invaluable on different projects throughout Europe and Africa, ranging from market model changes to seizing new business opportunities, such as PPAs.

What is a TOM for PPAs?

Managing PPAs requires a robust organizational and operational foundation, and a TOM provides a solid approach to reach that goal. On an organizational level, the TOM defines structures across the front-, middle-, and back-offices to support PPA management. On an operational level, it outlines detailed processes to ensure daily efficiency.

The TOM is a proven way to manage and integrate PPAs. Starting from industry best practices, a TOM identifies those organizational and operational components needed for PPA integration. The result is a tailored model for efficient PPA management that is aligned with the organization’s unique strategy and processes.