29.01.2020 / 16:12

Bye Bye NCG and GPL – Unifying the German gas market area

Energy Markets

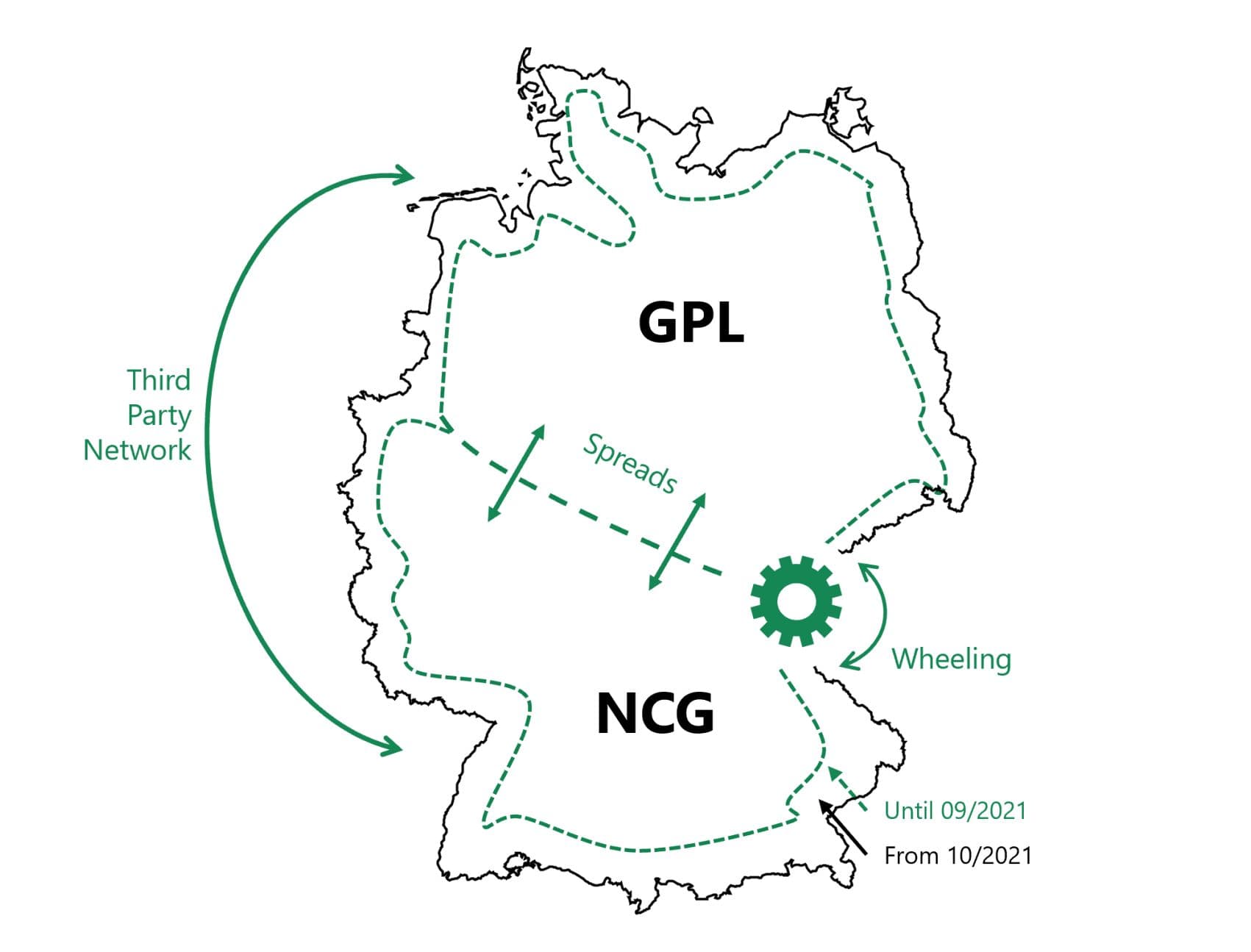

A big change is going to take place in the German gas market in 2021. The market areas Gaspool (GPL) and NetConnect Germany (NCG) are facing a convergence to one single market area, called “Trading Hub Europe” (THE).

The German gas grid access regulation constitutes a convergence of the market areas until latest 1st of April 2022. However, the current planning process focuses on target date 1st of October 2021.

Merging the market areas to one single entry and exit zone has significant impact on the organizational structure of market participants such as energy suppliers and commodity trading houses.

Especially physical constraints make the way to Europe’s most liquid trading hub a hard road. The grid between GPL and NCG only allows limited physical transport between both market areas. Thus, the allocation of entry and exit capacities for firm freely allocable capacity throughout the new German market area is limited. A capacity model designed by German transmissions system operators (TSOs) resulted in an expected reduction of firm entry capacities of 78% (H-Gas) compared to now.

To circumvent this massive reduction in firm entry capacity the Federal Network Agency introduced KAP+, a procedure for additional capacity in the German market area. German TSOs designed a joint concept for an overbooking and buy-back scheme and handed it over to the Federal Network Agency. Additional capacity shall be offered at entry and exit points which suffer from a reduction in available technical capacity caused by the market area convergence. In case of network capacity congestion, the concept intends to apply market-based instruments (MBIs), such as

Wheeling (routing short gas transports via certain border points through neighbour countries using their spare entry/exit capacity),

application of Third Party Network Use (similar to wheeling, but for longer distances),

or Spread Products (virtual transport via simultaneously buying gas from one grid and selling to another).

Depending on availability, for the order of use of MBIs mentioned a price-optimised merit order list is created and applied. Capacity buy-back shall only be used as Ultima Ratio in case the MBIs wheeling, third party networks or spread products are not sufficiently available.

The concept will enter a three-year testing phase (01/10/2021 – 02/10/2024) after the market area convergence.

The KAP+ consultation and concept process is planned to be finalized with its approval by the end of Q1 2020. There are yet overcome a whole set of regulatory, organisational and physical boundaries to achieve a successful market area convergence. Switching from two Market Area Coordinators to one, adjusting balancing group management, merging IT systems are only a few to mention.

For market participants, it becomes more important than ever to closely observe the markets. With merging market areas, trading opportunities arise and are realized by applying automated and algorithmic trading.

Are you prepared for the big change in the German gas markets? Use the early possibility and contact us to discuss the impact on your organization in detail.

Meet us in person at E-world in Essen at stand Halle 3 / Stand: 3-440 and follow FORRS on LinkedIn for recent insights into energy and financial markets.