27.03.2023 / 08:23

Crunching the numbers - SBTi - a science-based approach to ESG ratings

Financial Markets

Climate science is complicated, and asset managers are struggling to navigate the landscape of ESG regulations in order to find sustainable and transparent investments.

The challenge

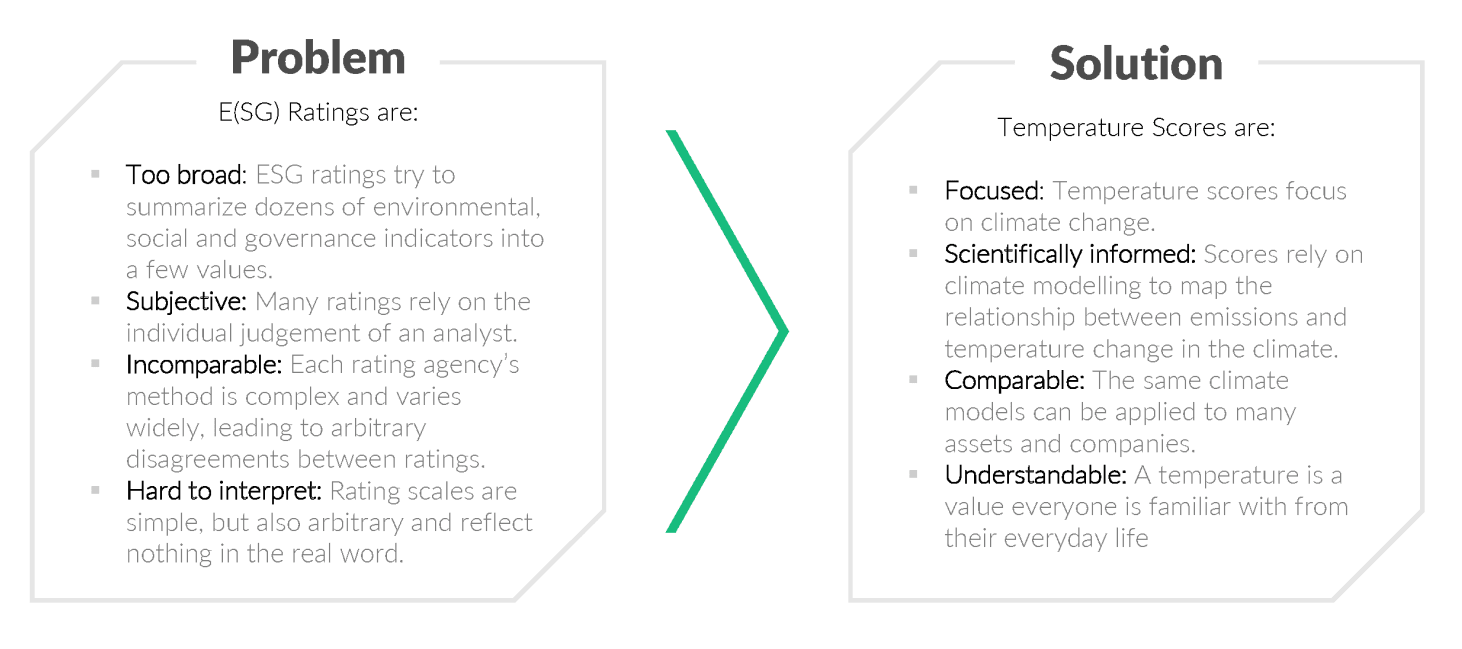

With climate change an imminent threat, an increasing number of financial actors are trying to integrate environmental concerns into their investment decisions. But modeling the effects of carbon emissions is not straightforward, and asset managers’ customers don’t always grasp the particulars of climate modeling. For example, ‘400 megatons of CO2 equivalent’ means little to a layperson. Often, rating agencies don’t help either as they produce qualitative ESG metrics that summarize the environmental sustainability of a company by relying on an analyst’s subjective assessment. In short, current ratings fail to accurately capture quantitative ESG characteristics, and this limits the expansion of green investing. In order to improve this situation, we must have a common understanding of how we can measure ESG. To that end, we need data that is both scientifically grounded and fully comprehensible.

Having such data at our disposal also helps combat a growing problem in the financial industry - greenwashing. Companies can claim to be environmentally friendly and make false claims about their products’ environmental benefits without the right foundations or coherent evidence to support such claims. This harms consumers, investors and the environment.

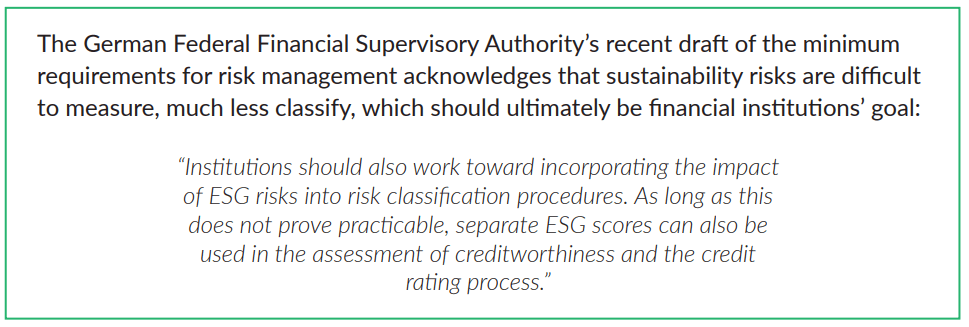

To address this problem, market regulators such as the European Securities and Markets Authority (ESMA) and the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin, Federal Financial Supervisory Authority) in Germany have taken action. ESMA has responded to investor concerns by releasing its Sustainable Finance Disclosure Regulation, which requires financial institutions to transparently and consistently report on how they integrate sustainability risks into their investment processes. The regulation also mandates that investors report on the sustainability of their investments and potential harmful effects they could have in terms of sustainability. For 2023, ESMA is focusing on developing a clear set of rules that will be modified based on feedback from market participants.

A major concern is the availability and quality of data, which affects market participants' reporting obligations and their ability to address sustainability issues. BaFin has released guidelines to help companies manage sustainability risks defined by ESG factors. However, measuring and managing sustainability risks can be challenging due to a lack of historical data, the need to consider multiple factors over a long period, and uncertainties about future climate and political scenarios. The science-based target initiative (SBTi) helps the financial industry overcome this challenge.

The solution

In November 2016, the Paris Agreement entered into force, with the objective to limit global warming to 1.5 Celsius, compared to pre-industrial levels. To achieve this goal, the Intergovernmental Panel on Climate Change (IPCC) warned in 2018, greenhouse gas emissions must be halved by 2030 and reach net zero by 2050. This means that every sector must undergo a transformation and set reductions targets that are science-based - i.e. in line with what climate science considers necessary in order to meet the Paris goals - and provide companies with a clear path to reduce emissions accordingly.

The Science Based Targets initiative (SBTi) framework offers a transparent, open-source solution, which describes a company’s sustainability, while constantly taking internationally recognized environmental objectives into account, i.e. whether their investment portfolios align with those goals. SBTi allows companies to set science-based targets for reducing greenhouse gas emissions, and it has developed a verification process to assess the credibility of a company’s sustainability claims, ensuring they are based on scientific evidence and aligned with the latest climate science. Thousands of enterprises that have set science-based targets by applying regression models used in IPCC’s climate examples are already making great strides in cutting emissions at scale; now other companies must follow suit.

Launched by multiple environmental organizations such as the United Nations Global Compact and World Resources Institute, SBTi converts carbon emissions reduction targets into understandable temperature scores that rely on climate modeling. Companies can set science-based targets by going through a five-stage process that involves committing to setting such a target, developing it according to SBTi’s criteria, submitting it for validation, announcing the target and informing stakeholders, and annually disclosing target progress.

Compared to qualitative ESG ratings, SBTi provides quantitative evaluation that enables investors to make science-based decisions, while also helping ESG to expand into the mainstream of finance. Its workflow - illustrated in the example below - can be broken down into three core steps:

Calculating scores for individual targets (i.e. converting targets to temperature scores with the help of climate modeling)

Combining targets for the company’s temperature score with the help of corporate emissions data

Aggregating the company’s scores across its entire portfolio

For this workflow, investors need granular target data, which details the scope, timeframe, type and other characteristics of each target.

Temperature score is a metric that answers a hypothetical question about the extent an organization plans to reduce its climate impact: “How large would the global temperature increase be if the entire world reduced its emissions by as much as the company being assessed?” The question is answered with the help of a database of climate models that quantify the relationship between emissions and temperature. Relying on a single standardized metric, asset managers can compare companies of different sizes and industries. For example, a business that is not aligned with any climate goals would be assigned a high temperature score. Any company, however, can set several targets based on varying characteristics.

Turning targets into scores

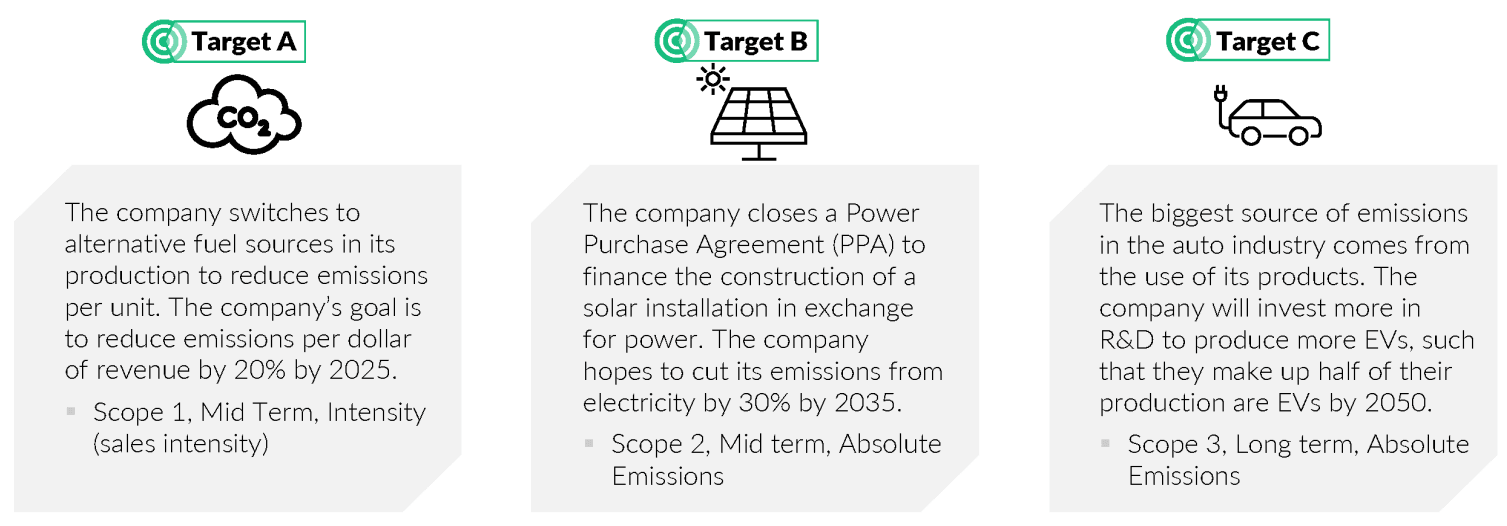

Imagine a large German car company that would like to reduce its emissions in various areas. It can determine its targets accordingly - let’s suppose that it has set three goals.

Reduce emissions per dollar of revenue by 20% by 2025 -> switch to alternative fuel sources in production

Cut emissions from electricity by 30% by 2035 -> close a power purchase agreement to finance the construction of a solar installation in exchange for power

Invest more in R&D to produce more electric vehicles

Knowing these three targets, we apply an appropriate regression model used in the SBTi framework, so we can determine the temperature score, i.e. the output for each target. The first target, for instance, would be mapped to the target class “GHG (greenhouse gas) Economic Intensity” and the second one to “Absolute GHG Reduction”. In order to ensure a fair comparison, however, you also need to generate company level scores, i.e. a score for each of the companies being invested in as a whole. So, you combine the temperature scores for the individual targets into a company-wide score, based on several factors such as target type, timeframe, progress, target scope coverage - which scopes are selected for the target - and boundary coverage, which shows how much of each scope’s emissions are affected by the target. Then the investing enterprise can aggregate its entire portfolio, which may consist of several companies with multiple targets, for a simple and clear sustainability metric.

Thanks to its scientific foundation and easily understandable, measurable results, SBTi offers the best of both worlds. Add to that its transparent methodology, and it’s easy to see why it has the potential to become an industry standard in ESG finance. Implementing SBTi can increase ESG awareness, help the fight against greenwashing and enable environmentally minded asset managers to take an active part in eco-investing. The economy would move closer to a fair, profitable and green future.