11.03.2024 / 08:30

Energy Market and Weather Derivatives

Energy Markets

Energy Markets

As discussed in Part 1 of this series, weather can potentially affect both the supply and demand of energy, particularly the supply of renewable energy. These variations affect market volatility and the wholesale price of electricity, largely due to the marginal costs associated with non-renewable sources.

In 2023, renewable energy generation contributed 59.9% (Figure 1) of the electricity generation in Germany. In comparison, renewable energy generation contributed 49.3% to electricity generation in 2022. As European countries aim to achieve renewable energy targets, this pattern will continue.

Figure 1: Percentage of Renewable electricity generation (adapted from Energy-Charts).

Weather-related Risk

In the renewable energy sector, prolonged or unexpected weather events can negatively impact energy production and lead to financial losses. Seasonal or daily changes in weather parameters such as wind speed, rainfall, sunshine or temperatures have significant consequences for the renewable energy sector. Below-average rainfall in a region could lead to lower water levels and impact hydropower generation. As a result, there is a need for power producers, utility companies and energy traders to manage the risk associated with such weather conditions.

Weather Derivatives

Comparable to widely known derivatives that are used to manage a range of risks, weather derivatives are financial instruments used to hedge against financial losses related to weather events. While insurance typically covers low probability such as tornadoes or flood and most importantly require loss to be demonstrated, weather derivatives cover high probability events such as warmer than expected summer temperatures. Weather derivatives are based on utilisation or yield and guard against volumetric risks to smooth out revenue fluctuations related to weather conditions.

How are weather derivatives used in the energy market?

The type of weather derivatives that will be used depends on the risk that is likely to affect a particular business. Common weather derivatives in the energy sector include temperature (heating/cooling degree days, cumulative average temperature), rainfall, snow, wind, frost, radiation, hail and fog.

For example, an energy company may buy a temperature-indexed contract to guard against warmer winter temperatures which would decrease gas sales. If the temperatures are warmer than expected during the contract period, a payout would be generated upon settlement. In the renewable energy sector, a wind farm may buy weather derivatives to guard against lower-than-expected winds which would result in decreased electricity production and not being able to supply contracted clients.

Dynamic hedging strategies use models of energy and temperatures to hedge energy futures using temperature futures. In this way, companies can hedge against price movements and decrease their risk in a volatile market.

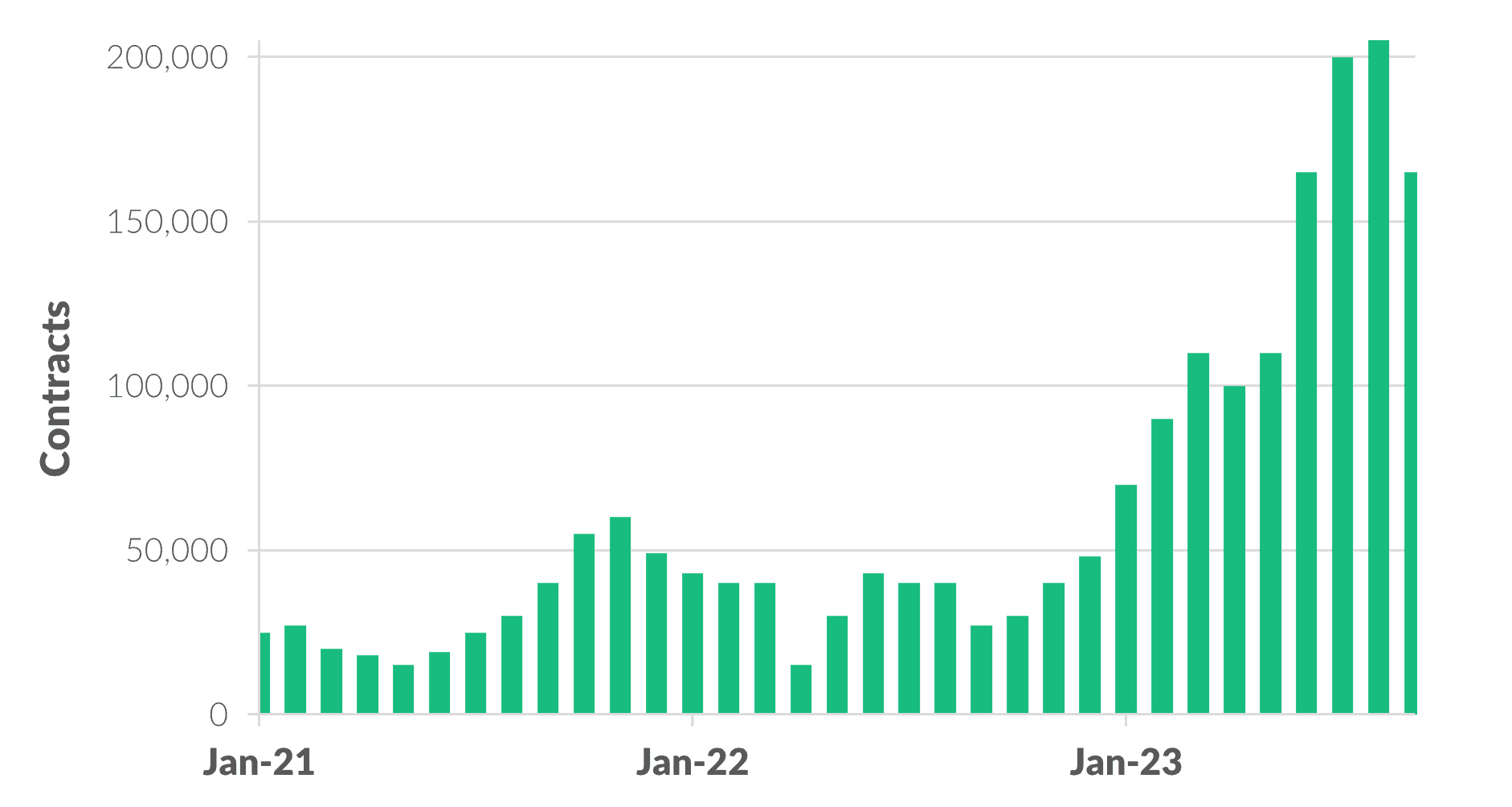

The demand for weather derivatives has seen significant growth in recent years (Figure 2). The average open interest in weather futures and options for 2023 (January – September) was four times higher compared to 2022 and twelve times compared to 2019. The growth is largely due to companies looking to protect themselves from extreme weather events.

How are weather derivatives traded?

In the late 1990s, weather derivatives were traded as over-the-counter (OTC) contracts and were soon traded on exchanges as well. Online platforms allow for trading of OTC contracts and derivatives with a variety of underlying weather parameters. Trades are often available with a variety of maturity dates and are settled using grid point data from weather models or weather station observations.

Until recently the weather derivatives were relatively unknown and were limited to the renewable energy sector. As a result, the weather derivatives market is approximately ten times smaller compared to crude oil. However, as more market participants get involved the market is likely to grow.

Figure 2. Average open interest in weather future and options per month from Chicago Mercantile Exchange (Adapted from CME Group)

Conclusion

An improved understanding of how weather conditions influence the energy market can assist in mitigating the financial risks associated with weather conditions. Through the use of financial tools like weather derivatives, energy traders and producers can improve their risk management.