08.02.2021 / 09:47

ESG Part 1: Welcome to the jungle (of ESG Ratings)

Financial Markets

Sustainability is the new norm, but how do you really measure it? There has been a lot of talk about sustainable investments, but how do you choose the right ones? Most asset managers come up with new solutions, but clients remain skeptical: how can you tell the difference between value-added approaches and possible greenwashing?

The environmental (E), social (S) and governance (G) dimensions of companies are inherently difficult to assess. For this reason, many specialized rating agencies have been publishing their opinions on the non-financial performance of companies since the sustainability ratings first emerged in the 1980s. The initial idea was to help investors screen companies not purely on financial characteristics, but also on characteristics relating to social and environmental performance.

The earliest ESG rating agency Vigeo-Eiris was created in 1983 in France and five years later Kinder, Lydenberg & Domini (KLD) was established in the US. While initially catering to a highly-specialized investor clientele, such as faith-based organizations, the market for ESG ratings has widened dramatically, especially in the past decade.

As of Q3 2020 the ESG rating market has grown to approximately 120 firms providing over 600 ESG ratings and 4000 associated ESG KPIs. Represented in these numbers are a number of well-known firms such as MSCI, Bloomberg, FTSE, Thomson REUTERS, Sustainalytics, RobecoSAM, but also specialist providers such as Trucost, ISS and EcoVADIS.

One would think that the sheer amount of coverage and collected data would lead to an efficient and consensual ESG rating market similar to the credit ratings market. Unfortunately, this not the case. Confusion about the ESG performance of publicly traded companies persists as the rating agencies disagree to a large extent. To put it in the words of Jean-Pierre Gomez, Head of Regulatory & Public Affairs, SocGen Luxembourg “the financial market does not have reliable data to confirm that assets or products meet all three ESG criteria”.

Although the EU has established a Taxonomy, trying to set a common language between investors, issuers, project promoters and policy makers and thereby help investors understand whether an economic activity is environmentally sustainable or not, there are no commonly agreed ESG rating standards as of today. This fact leads to a number of consequences:

Asset managers struggling to show their value through ESG analysis

Companies discouraged from improving their sustainable performance

Institutional clients who are unable to compare multiple funds due to the variety of ESG methods

The ESG rating „jungle“ arises from a combination of challenges :

The taxonomy of ESG is not set in stone and the interpretation of the definitions can change depending on the social and cultural context in which the rating agencies operate. For example, the legal origin of the countries in which the ESG rating providers are headquartered can lead to disagreements between them. In addition, rating agencies have different frameworks for measuring and aggregating ESG information. The meaning of the attributes used to assess the company’s sustainability footprint varies and leads to different assessment results.

The lack of standardization makes it difficult to efficiently measure the impact of ESG because the quality of disclosure varies and many non-financial measures require subjective interpretation with redundant indicators adding ”noise“. Many investors rely primarily on ESG rating agencies to assess these factors. However, various reports and publications have found that, on average, the ESG ratings of these companies show little correlation to one another, and such conflicting information creates confusion among several stakeholders. Opinions differ considerably even on the environmental dimension, for which the underlying quantitative data availability is greatest. For example, a study by researchers from MIT shows that the average correlation between measurements of companies’ greenhouse gas emissions by two rating agencies is close to zero!

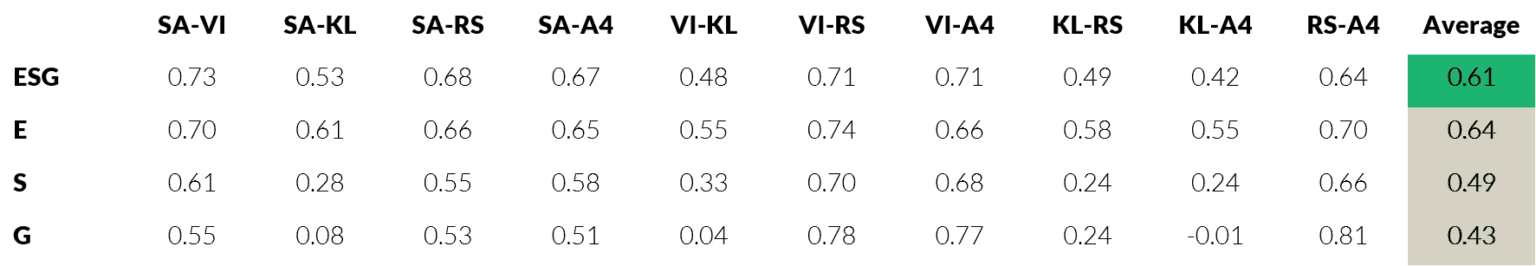

The findings of the MIT1 study, which examines the corporate ESG ratings from five leading rating agencies, disappoint: the pairwise correlations of the overall ESG rating, a measure of overall performance across the E, S, and G dimensions, averaged only a mere 0.61. For comparison: credit ratings, which are also based on different data sources, procedures and assessments, are correlated approximately with 0.99. The correlations are lowest for the social (0.49) and governance scores (0.43), an indication of the challenges and subjectivity associated with these scores. At 0.64, the pairwise correlations of the environmental ratings are highest on average.

This in itself is not surprising. It is expected that the measurement and disclosure of the underlying corporate environmental data, such as the CO2 emissions from energy consumption, is appropriately standardized. However, with a correlation of 0.64, this is still a disappointingly low number.

Correlations between the different categories from different rating agencies. Average value for each criterion on firm level. SA, RS, A4, KL are short for Sustainalytics, Robeco SAM, Vigeo-Eiris, Asset4 and KLD

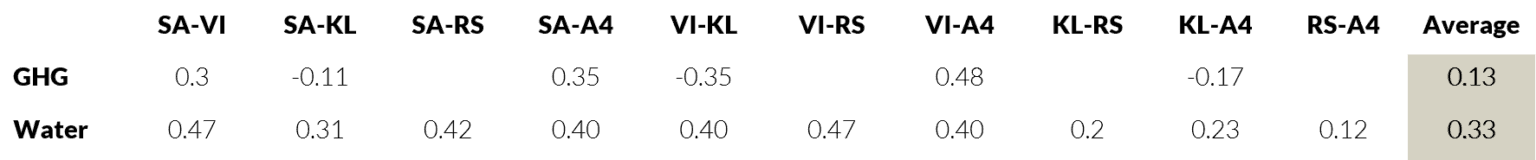

On a more granular level things don’t look much better. Categories that should be rather straight forward, as they are quantitatively measurable based on corporate environmental data, are greenhouse gas emissions (GHG) and water usage. Even within these specific categories, the rating agencies disagree. The average correlations are a strikingly low 0.13 for GHG (with some agencies having even negative correlations among each other) and a disappointing 0.33 for water usage.

This remarkably low correspondence between ESG agencies contradicts the previous view that there is an allegedly straightforward assessment of quantitative environmental data. The environmental dimension however is the strongest link to economic value and is undoubtedly complex, but it also offers significant investment opportunities. Having an accurate and consistent definition of what is to be measured, such as the efficient use of resources, and a focus on objective quantitative metrics such as the use of natural resources are critical.

On a corporate level things can get confusing too, comparing company ratings from different ESG rating agencies yields surprising results. For example, MSCI rates a big Oil & Gas company like BP higher on the ESG scale than Netflix. Sustainalytics however disagrees and rates Netflix higher. When comparing apple to apples things are not much clearer. Shell, which had one of the world’s biggest oil spill in recent history rates higher than BP (and higher than Netflix) according to MSCI, again here Sustainalytics disagrees.

Given that there are now around $ 30 trillion in assets invested around the world based in one way or another on ESG scores, the fact that opinions about the sustainable performance of companies are barely coincident is causing significant problems. The mixed ESG rating signals can significantly distort investor perception and make it difficult for them to effectively incorporate sustainability into investment decisions. As a result, one can question if ESG performance is adequately reflected in company stock prices as investors face a challenge trying to identify outperformers and laggards.

This will be the subject of our next post as we continue the journey, analyzing the correlation between stock market performance and ESG ratings, stay tuned!

References

(1) Aggregate Confusion: The Divergence of ESG Ratings Florian Berg, Julian F. Koelbel, and Roberto Rigobon, MIT Sloan School Working Paper 5822-19, August 2019