22.09.2020 / 08:00

Hit By Year-End

Financial Markets

Before the end of the year 1999, people using IT systems across industries feared that systems would take serious damage from the so-called Y2K effect (many applications stored dates with only two digits representing the year and it could happen that “1.1.00” was interpreted by the system as of Jan 1st, 1900 instead of Jan 1st, 2000). 20 years later we know that Y2K had no material impact.

One reason for this might be that the issue had been known long before, another one that a lot of time and money (around 100 bn USD only in the US) had been invested to be properly prepared. This article is focused on regular end-of-year (EOY) procedures in banks with professional trading business Investments where corresponding costs do of course not reach the above-mentioned dimensions. Quite contrary, one might expect the existence of clear market standards on how to proceed at EOY, respective governance by regulators and auditors, well-established and reliable processes making investments unnecessary. However, this is not entirely the case.

First, maybe surprisingly, but the end of the calendar year is not necessarily the relevant End-of-year date for every market participant, for a variety of reasons:

First choice could be Dec 31st. Being Saturday or Sunday with no trading activity and consequently, no market data is available as of this date.

But also if Dec 31st is a weekday: Typically, there is comparably low liquidity on this day and some markets are even closed. Given these reasons, some market participants use the last business day before Dec 31st.

Some even don’t use this one because it is perceived that market makers use their competitive advantage and the poor liquidity at EOY to quote market parameters in their favour.

Regardless of the relevant date (and – by the way – also time!) used to fix market parameters, some institutions – despite using market data from a day before Dec 31st – do apply Dec 31st as valuation date (in order to reflect respective accrual or Theta effects), others do not.

Consequently, valuations for identical financial instruments can vary across different institutions. However, if no big market movements can be observed at EOY (this has been the case in the recent past), the respective impact is negligible. And from a single market participant’s view, it is only a question in which fiscal year the P&L in question is disclosed, there is no money made or lost due to the choice of a different EOY date.

However, actual losses (or profits) caused by EOY procedures did happen in the past. Let’s look at a very simple example. Imagine a EUR bank founded on Jan 1st, 2020 with 1 million Euro equity and no debt. Imagine further that on day one, the whole equity amount has been invested in the trading book to buy Microsoft stocks on Nasdaq. Funding of the USD amount was done via an FX Swap maturing in one year. Following market data are observed:

FX Rate EUR/USD = 1

Yield curves in EUR and USD flat @ 0%

Stock price Microsoft at purchase = 200 USD

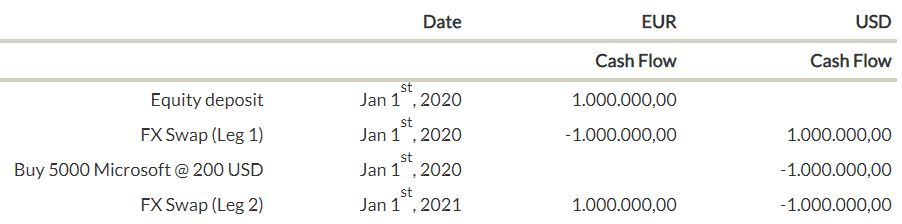

Risk management is done in the bank’s front office system. All relevant transactions are recorded there and one would expect the following cash flow structure:

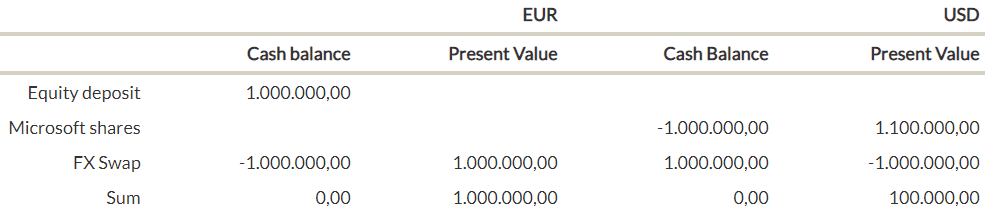

At year-end, the bank’s book is closed. Microsoft’s share price has moved up to 220, FX and interest markets didn’t move at all. So we would observe the following figures:

Quite obviously, the bank earned a profit – arising from the value change of the shares. Since the reporting currency of the bank is EUR, all amounts in foreign currency must be translated into EUR and the bank would report a profit of USD 100.000 ∗ 1EURUSD = 100.000 EUR. The responsible trader might be compensated for his good performance with a bonus in the upcoming spring. Later in 2021 at the bank’s annual general meeting, it might be decided that dividends are paid out. However, it is important to state that in our example there is no actual cash flow at year-end. More generally, cash flows simply do not happen out of the blue solely because year-end is reached. This is a fact.

However, some banks do ignore this within the scope of their end-of-year procedures: While pursuing the target of resetting the P&L framework, they are manipulating cash balances with the effect that front office system positions do not reflect reality anymore. Let’s go back to our example in order to get a better understanding: One way to reset P&L is to insert a cash booking in the amount of P&L in currency times -1 (let’s call this Alternative 1). In our case, this would imply a cash booking of -100.000 USD. Right after year-end with no markets moving, P&L would be 0 USD and hence, 0 EUR (as expected). More generally, Year-to-Date P&L would be calculated in the Front Office System as follows:

P&L_YtD

= Present Value (in CCY) ∗ FX Rate (EURCCY) + Cash Balance (in CCY) ∗ FX Rate (EURCCY) −YearEndCorrection (in CCY) ∗ FX Rate (EURCCY)

= [Present value (in CCY) + Cash Balance (in CCY) − YearEndCorrection (in CCY)] ∗ FX Rate (EURCCY)

= 0

We can see from the equation that, if PV and Cash Balance would not change after year end, P&L figures would also not fluctuate.

As stated before, Alternative 1 is a procedure commonly offered by front office systems. Traders might like this because they can start the new year with a “clean position” in every currency. However, this is not in line with accounting procedures and – in particular – reality. This EOY correction cash flow of -100.000 USD did not really occur and leads to a misrepresentation of risk: Since the reporting currency of the bank is EUR, every non-EUR cash flow bears FX risk exposure. If an artificial cash flow in foreign currency is entered, the FX risk position available from the Front Office System is wrong.

In our example, assuming that PV and CB stay constant in the new year and FX markets moving, the artificial -100.000 USD EOY correction would keep P&L figures still constantly at zero. Accounting figures would show different results because the -100.000 USD correction cash flow would not have been booked in accounting systems. Within reconciliation of accounting and economic P&L, it might be detected eventually that there is a difference. In the past, it happened more than once that until then significant losses (or profits) already have been accumulated.

We have seen so far that Alternative 1 might not be a good idea. So how about Alternative 2: In order to avoid the FX risk misstatement, a cash booking in the amount of P&L in accounting currency (here EUR) is inserted.

In our example, we would book a cash flow of -100.000 EUR. This would reset the EOY profit of 100.000 USD to zero. And, since no FX cash flow is involved, the FX risk position apparently would stay as it was before. In terms of P&L fluctuation, future moves in the EUR/USD FX rate would impact the P&L because the EOY FX rate is implicitly fixed within the EOY adjustment in currency EUR. So if EUR/USD would move to 1,5 while PV’s and CB’s in currency remain constant, P&L would move accordingly:

P&L_YtD

= Present Value (in CCY) ∗ FX Rate (EURCCY) + Cash Balance (in CCY) ∗ FX Rate (EURCCY) − YearEndCorrection (in EUR)

= 1.100.000 USD ∗ 1,5EURUSD − 100.000 EUR

= 50.000 EUR

Thus, if Alternative 2 is applied, the risk position available from the Front Office System would be correct. At the same time, we know also that there is no real cash flow in the amount of -100.000 EUR at year-end. Does this create any issues? Not from a market risk perspective. However, the Cash Balance in reporting currency is misstated. Consequently, EOY correction cash flows should not be considered for the calculation of funding needs.

Furthermore, in case theoretical funding costs apply within the P&L calculation, the calculation basis would be distorted. Assuming a constant funding rate of 1% p.a. in our example, the EOY correction cash flow would produce an artificial and unjustified -1.000 EUR loss from funding costs.

This problem could be avoided by Alternative 3, a slight modification of Alternative 2: Here, all EOY correction cash flows are input using an artificial currency, say “EOY” for which a constant exchange rate of 1 is applied versus the reporting currency. Cash flows in currency EOY are excluded from funding positions and are not subject to theoretical funding costs. FX risk is represented correctly. This is maybe the cleanest way to begin the new year.

So far theory is explained by a very simple example. Reality is by far more complex: Front office systems contain up to millions of trades in different instruments, often more than one front office system is involved, of course, there is a portfolio structure containing a lot of desks with individual mandates, positions are mirrored, special processes have evolved for historical reasons and workarounds do exist. For correct EOY treatment, it is of paramount importance to reflect this complexity resp. reality.

While application of Alternative 3 would put you on the safe side, you might get through also with Alternative 2 (in case of funding tickets setting all cash balances to zero on a daily basis) or even with Alternative 1 (in case all FX P&L is – actually – sold down to reporting currency on year-end).

We have seen that there is an operational risk exposure created by methodically incorrect EOY procedures. Additional operational risk exposure can arise by failure or delays of these processes. If traders have no access to correct risk exposures, proper risk management is not possible. Accordingly, strong governance concerning EOY methods and processes helps to mitigate this risk.

More concretely, we recommend having a look at the following aspects:

Start EOY planning punctually in order to have a timely reconciled (and where appropriate changed) procedure.

Make sure that your EOY method (still) reflects reality, in particular perform respective reviews with regard to changes made in your application and process ecosystem since last year-end.

Determine the relevant EOY date and market data used long before, reconcile this with all internal stakeholders as well as external auditors.

Perform comprehensive test runs following a well-documented runbook and get approval of all stakeholders in order to minimize operational risk and prevent EOY losses.

As a conclusion we can state that each year-end is for sure not comparable with Y2K, nevertheless, it is reasonable to invest in proper procedures to avoid losses from respective operational risks.