07.04.2020 / 13:20

IBOR Transition Compass

Financial Markets

1. How will the LIBOR Endgame play out?

In January the UK Working Group on Risk-Free Reference Rates (RFR) declared the cessation of GBP LIBOR-based cash products by end of Q3 2020 as their top priority. Therefore, when it comes to predicting the future of LIBOR after 2021 only two options are viable.

First, the rate could be discontinued and must be replaced in all outstanding contracts. Second, as intended by the ICE Benchmark Administration, LIBOR may be continuously used in legacy contracts and only new contracts would contain the new risk-free rates [1].

The second option is more desirable and would take pressure of the efforts to come up with fallback clauses for legacy contracts, but it is also less likely to materialize. Therefore, it is crucial for the industry to agree on fallbacks that are compliant with the EU Benchmark Regulation (EU BMR) over the course of this year.

The International Swaps and Derivatives Association (ISDA) is spearheading this effort by launching several consultations among their member institutions to evaluate possible solutions [2]. While the work of ISDA is serving the purpose to provide robust fallbacks the central banks are in parallel promoting the extended use of the new risk-free rates, which includes the construction of term rates to be used also in new products [3].

2. The Progress of the Alternative Rates

The new RFRs are overnight rates and therefore backward-looking in nature. To convert these rates to term rates that could substitute LIBOR in new or old contracts two approaches are currently discussed:

Setting-in-arrears, which will provide a compounded rate and the end of the observation period

Market-implied prediction, which will provide a compounded or averaged rate at the beginning of the observation period

So far it looks like the industry favours a forward-looking term structure. But these rates must be BMR-compliant as well, which implies enough liquidity in the underlying derivatives contracts to avoid expert judgment in the process of providing the rate, the reason which led to the benchmark reform.

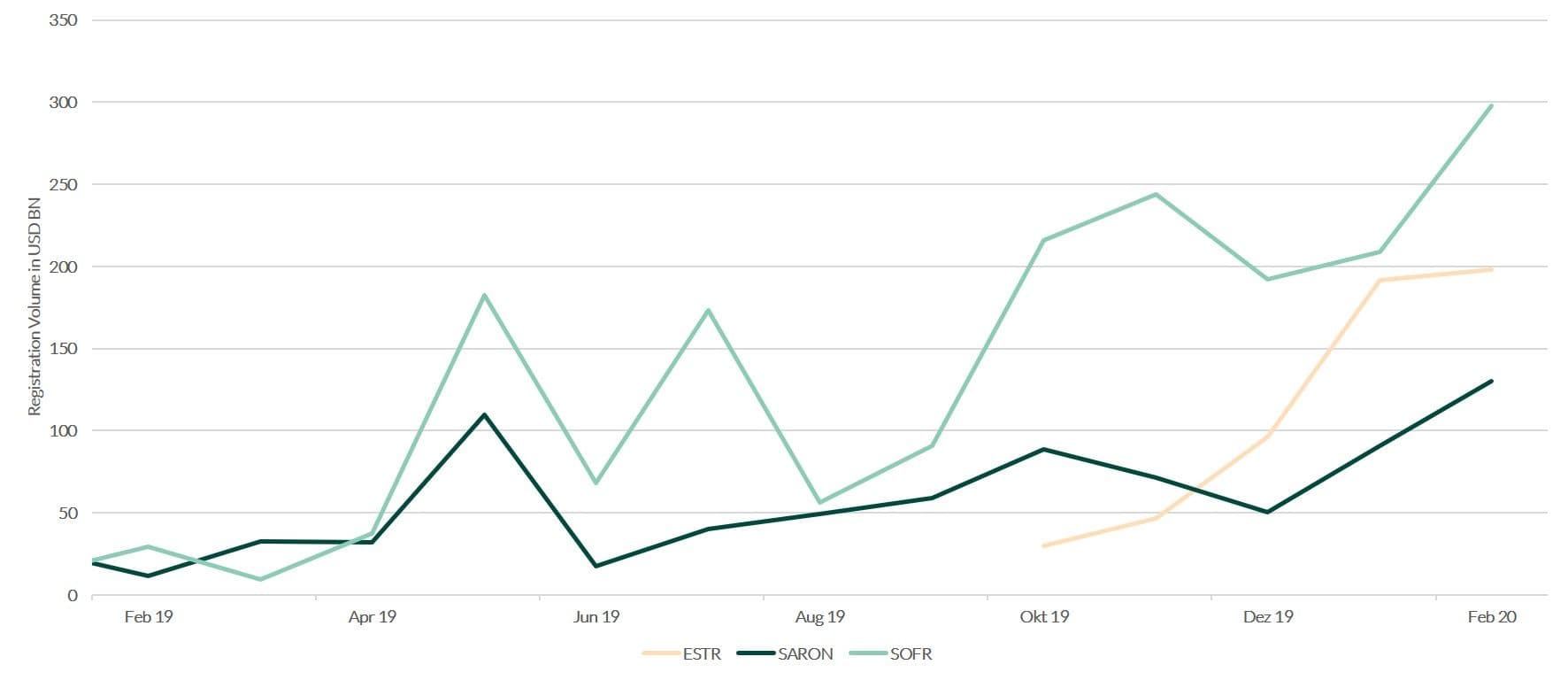

Therefore, it is interesting to look at the liquidity in RFR-linked swaps which would serve as an underlying for potential term rates. In Figure 1 the monthly volume of cleared swaps on the London Clearing House (LCH) platform is shown. It clearly indicates an upward trend for the three RFRs. But in comparison to the aggregated 113 trillion USD monthly cleared swap volume on LCH there is still a long way to go. Especially since around 90% of the swaps have a tenor below one year.

The next nine months will show if the shift is material or not, but a significant boost is expected on Monday 22 June 2020 when clearing houses aim to switch to ESTR for central counterparty discounting. This will push market participants to amend their bilateral credit support annexes.

Figure 1: LCH Swap Clear RFR Statistics [4]

3. Risk Related to Fallback Clauses and Triggers

The focus of most market participants lies in updated fallback provisions to manage the transition when current reference rates become unavailable. Depending on the number of outstanding contracts an entity is holding this may create severe operational risks. In a worst-case scenario many fallback formulae, interest payment schedules, valuation calculations, and collateral/margin processes must be changed on short notice.

Additionally, while for most derivatives the ISDA fallback rules will be sufficient, the fallback language found in bond/debt contracts is very diverse and could result in unintended consequences. The fallback clauses for these contracts must be evaluated and re-negotiated individually which might lead to significant manual efforts.

Additionally, there are different definitions of the reference rate itself and varying triggers for the discontinuation. The most prominent result could be a floating rate instrument falling back to a fixed rate. This increases the basis risk or completely dissolves evaluation units with potentially severe impact on the balance sheet. Another common risk is the current practice for fallback clauses to leave the lender with the obligation to determine the rate by himself. In this case, he would have to obligation to aggregate several quotes by major banks, a practice which is not feasible.

To avoid any unpleasant surprises financial institutions should continue to:

Stay involved in stakeholder communication and coordination

Ensure operational readiness by educating staff and enhancing IT-systems

Evaluate the currently used rates and fallback clauses

Reduce legacy contract exposure and adopt the new RFRs

References

[1] See https://www.theice.com/iba/libor

Of course, there is a third viable option: to extend the transition period once again

[2] See https://www.isda.org/2020/02/25/isda-launches-new-consultation-on-pre-cessation-fallbacks/

[3] See https://www.ecb.europa.eu/paym/initiatives/interest_rate_benchmarks/WG_euro_risk-free_rates/html/index.en.html

[4] See https://www.lch.com/services/swapclear/volumes/rfr-volumes