27.02.2024 / 08:00

Insights from GoO Price Trends

Energy Markets

In this latest article, we return to our series #GuarenteesofOriginDemistified to delve into the complex journey of Guarantee of Origin (GoO) price development, from their historic lows influenced by abundant supply and external shocks such as the COVID-19 pandemic, to the more recent upsurge in corporate demand and regulatory changes reshaping the market. We explore the critical factors that have contributed to the significant spikes in GoO prices, examine the current trends, and provide insights into the potential future trajectory of this market.

Guarantee of Origin Price Development

Traditionally, the market for GoOs was characterized by relatively low trading prices, often falling below the 1 EUR/MWh mark. This phenomenon can be largely attributed to an oversupply in the market, especially from abundant Norwegian hydropower certificates. Corporate interest in sourcing 100% renewable electricity has furthermore historically been subdued. Moreover, the impact of the COVID-19 pandemic exacerbated this situation by causing a downturn in electricity demand, which further suppressed GoO prices to the extent that they were traded between 0.1 and 0.4 EUR/MWh in 2020.

The GoO pricing landscape has however been experiencing a notable transformation leading to rising prices since 2021 and a further significant spike during 2022/23, which saw spot auction prices greater than 7 EUR/MWh. Reasons for elevated prices most notably include:

Increased Demand: There has been a significant increase in demand for GoOs, particularly driven by corporate consumers aiming to switch to renewable energy sources. This demand is fueled by companies joining initiatives like RE100, committing to 100% renewable energy usage. The demand for Wind and Solar renewable certificates, in particular, has caught up with the supply, leading to higher prices.

Regulatory Changes and Ambitions: The evolving regulatory landscape and the push for higher renewable energy targets by governments have led to increased demand for GoOs to meet compliance requirements.

Weather Conditions and Hydroelectric Production: Dry weather conditions and reduced hydro reserves have led to decreased hydroelectric generation, which in turn has affected the supply of hydro GoOs.

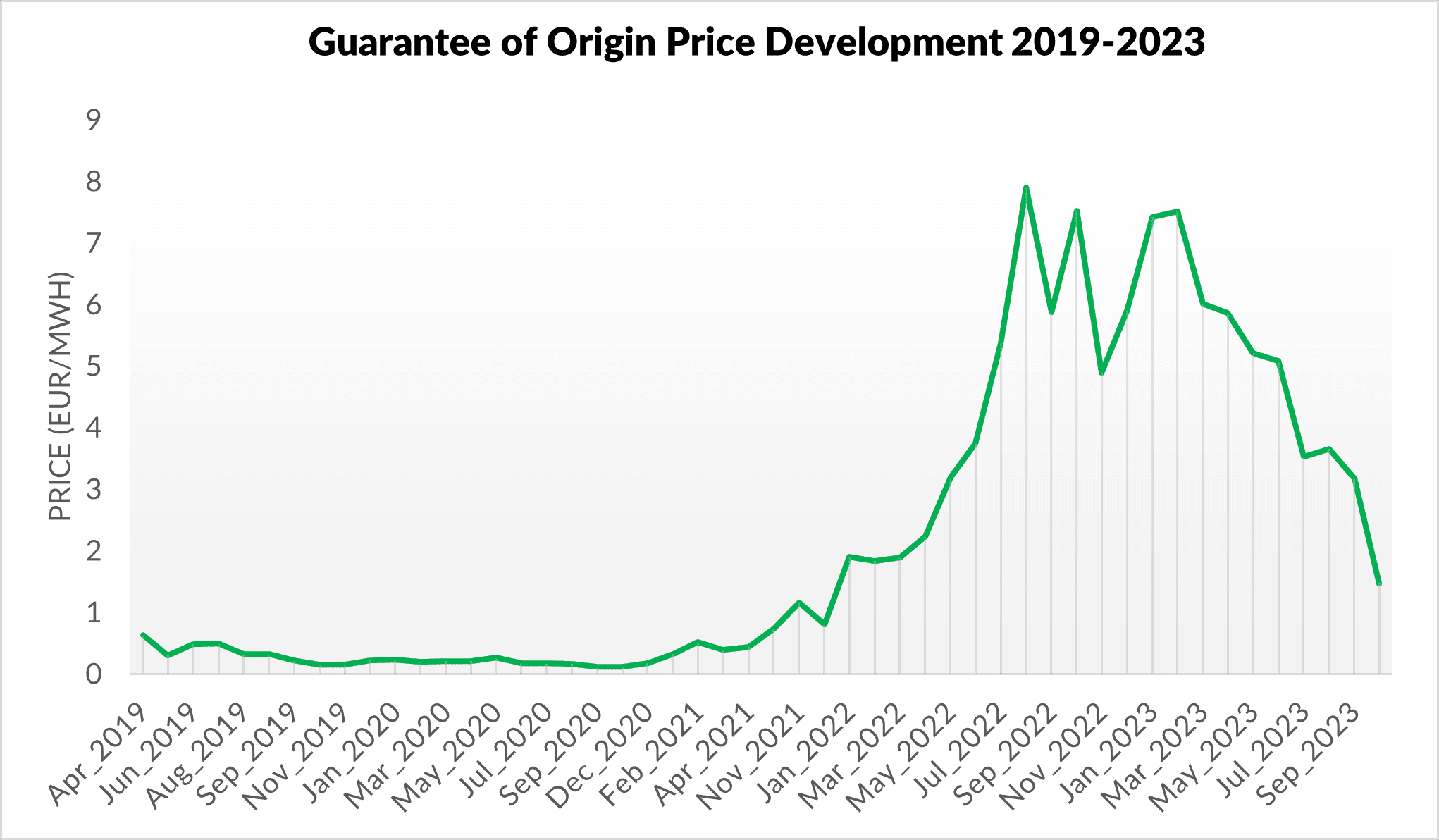

Throughout 2023, GoO prices experienced a substantial decline, yet they maintained levels significantly higher than those seen in 2021. This reduction in prices can largely be attributed to the enhanced generation of hydro and wind electricity, particularly in the Nordic and Iberian regions, which led to increased availability of GoOs and exerted downward pressure on their prices. Additionally, the incorporation of nuclear power into the EU's green taxonomy could have played a role in the price reduction. This is partly due to the expansion of the certificate supply and partly because nuclear GoOs tend to be priced lower than those for traditional renewable sources, which may have contributed to the broader decrease in GoO prices. Figure 1 depicts the weighted average GoO price development from 2019 to 2023, showcasing data from EEX auctions for the French market and encapsulating the price trends and developments outlined above.

Figure 1: GoO price development from EEX auctions for France (April 2019- Oct 2023)

The Transition to Contango: Future GoO Price Expectations

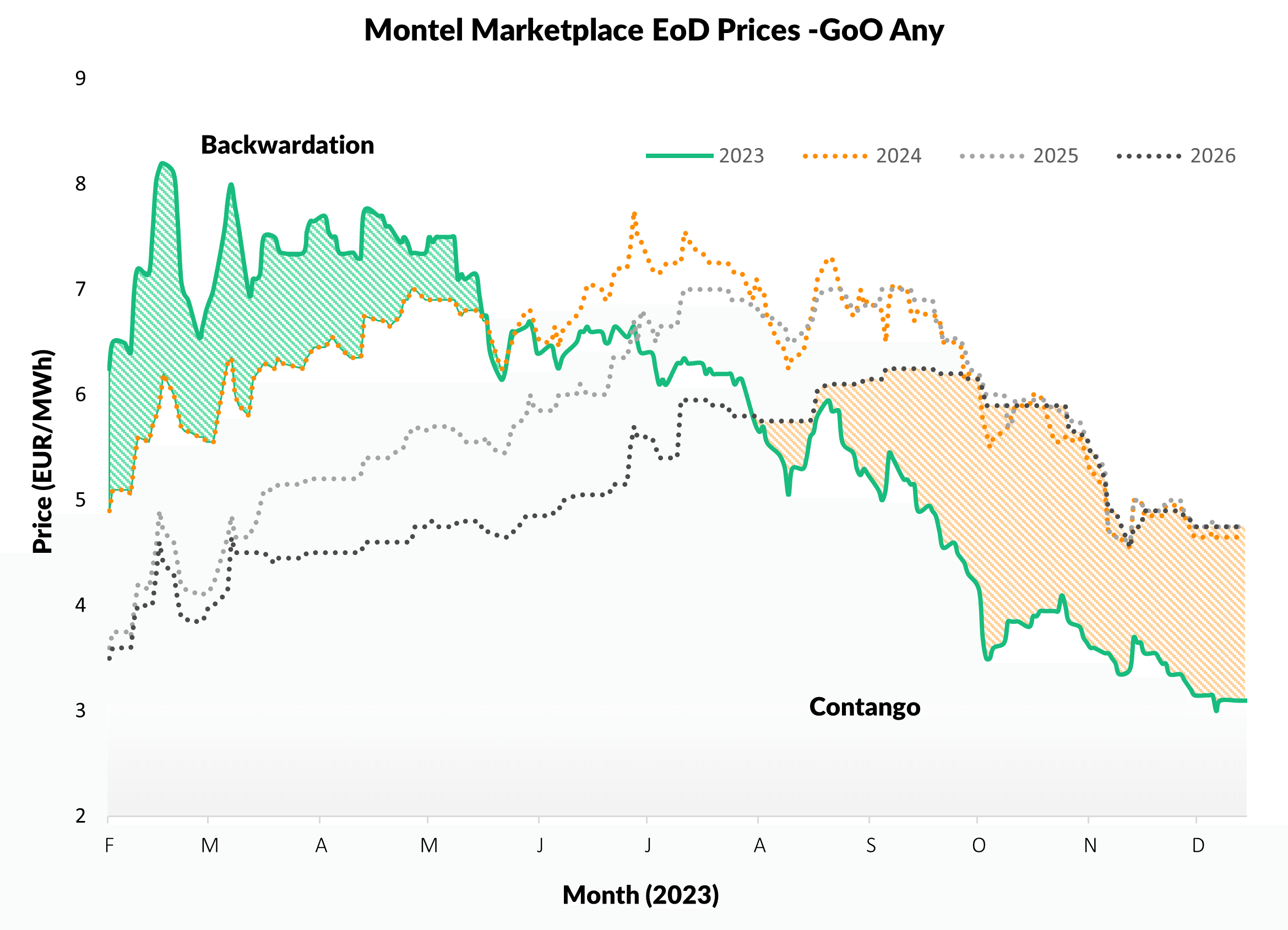

To facilitate transparency of market prices, Montel Marketplace provides the market with free access to GoO prices. Such price transparency is important to the further development of the GoO market. Figure 2 below shows the development of Montel Marketplace EOD prices for GoOs (any) through 2023, for the spot (2023) and forward (2024, 2025, 2026) GoO contracts.

From Figure 2 the following observations can be made:

Backwardation at the Start: Initially, the forward prices for the nearer years (e.g., 2023 and 2024) are higher than those for the later years (e.g., 2025 and 2026), and they decline over the subsequent months. This indicates backwardation, where the near-term forward prices are higher than the long-term forward prices, suggesting that the current or near-term demand for GoOs is high relative to supply, or there are expectations of increased supply or reduced demand in the future.

Shift to Contango: Later in 2023, the price curve for 2023 falls below the curves for the later years, indicating a shift to contango. Thereby the forward prices for the later years are higher than the current or nearer years, suggesting that the market expects the price of GoOs or the cost of renewable energy to increase over time, possibly due to anticipated supply constraints, policy changes, or growing demand.

Figure 2: Montel Marketplace End of Day (EoD) prices for GoOs for years 2023-2026

Shifting Expectations & Hedging in GoO Markets

Figure 2 shows evidence of changing market expectations throughout 2023. The presence of both contango and backwardation in different parts of the forward curve could furthermore suggest active hedging. The shift towards contango may, for example, incentivise consumers to buy forward contracts at the current prices to guarantee their cost for GoOs in the future, protecting themselves from potential price increases. Producers, on the other hand, might hold off on selling forward contracts, anticipating better prices ahead or selling in the spot market if the immediate prices are advantageous. Reasons for current market expectations of higher future demand and tighter supply may be attributed to the following:

Increasing Amount of PPAs: The European Union is promoting Power Purchase Agreements (PPAs), making them more accessible and potentially diminishing demand for unbundled GoOs. With GoOs increasingly being bundled with power purchased through PPAs, they will be taken off the open market. This could lead to a rise in prices for unbundled GoOs due to their reduced availability.

Power to X Investments: As investments in Power to X technologies, such as larger green hydrogen plants, increase, there will be a growing demand for GoOs from these entities. These plants will likely buy GoOs to label their hydrogen production as green, contributing to the shift towards contango in the forward market as they hedge against future price rises.

EU Sustainability Regulations: The European Union's Corporate Sustainability Reporting Directive, which came into force on 5 Jan 2023, requires stronger reporting for sustainability claims, especially from very large companies, may influence market expectations.

Conclusions

As we conclude our exploration of the GoO price development, it's clear that the market has undergone significant transformations. From historic lows driven by abundant supply and the impacts of the COVID-19 pandemic to a resurgence in prices fueled by increasing corporate demand and a rapidly evolving regulatory landscape, the journey of GoO prices encapsulates the dynamic interplay between supply, demand, and policy. The notable shift towards contango in the latter part of 2023 underscores the market's adaptive response to anticipated future trends, including tighter supply and growing demand, spurred by initiatives such as Power Purchase Agreements (PPAs) and investments in Power to X technologies. As we navigate through these changes, the insights gleaned from the price developments of GoOs offer a valuable perspective on the renewable energy market's future, highlighting the importance of transparency, hedging strategies, and the continuous influence of sustainability regulations. The evolving GoO market thus remains a critical barometer for the renewable energy sector, reflecting broader trends and shaping the trajectory towards a more sustainable energy future.