17.07.2021 / 15:00

Intraday Power – Algo

Energy Markets

A roadmap towards automation

Intraday power traders: is your performance where you want it to be? Or is there room for improvement?

What if you could react faster, step back from the basics like position closing and put your energy into advanced strategies to enhance your bottom line?

Manage your data – fast but consistently

Algorithmic traders, do you want to boost your results? In this series of posts we’ll again examine paramount aspects of the digital transformation happening in the energy trading sector – especially in the area of algorithmic trading.

Not surprisingly, it all starts with DATA and managing it effectively.

Chances are, you’re already swimming in data. The problem is managing it – consistently, correctly and fully, but also faster than what you could do manually. Once more, automation is the solution. Algorithmic traders’ take away:

Consistent and up to date data enables you to generate the most accurate orders at any time, which is paramount for any professional trading desk

Data is your main asset, so manage ALL of your data in a professional application environment so it becomes easily accessible and usable

Get rid of unsupported applications such as Excel sheets with their ever-increasing complexity – the involved risks are not worth it

How competitive is your trading data management? How could it be improved? What is your first step tomorrow?

Execution is king!

Do you think your algorithmic energy trading could do better? In part two of our series on the digital transformation of energy trading, we’ll learn why EXECUTION is king.

Purely manual execution will someday be a thing of the past. The market has simply become too fast, too volatile and too fine-grained for human traders to handle it on their own.

When you buy or build a professional execution tool to place your orders reliably

losses due to execution errors or poor execution timing will go down

your execution timing will speed up, allowing you to capture the best prices

Automating your execution allows you to

ensure optimal position closing 24/7 without being glued to a screen

exploit your asset’s flexibilities in an optimized and constant manner

ease your team and time to develop new trading ideas and strategies instead of manually hunting errors on a daily basis

How mature is your trading execution – and how could it be better?

Constantly monitor your trading results!

Are you satisfied with your intraday power trading results? In part three of our series on the digital transformation of energy trading and especially algorithmic trading, we’ll take a look at your CONTINUOUS IMPROVEMENT.

Execution is not the complete story! Trading success is achieved by monitoring, validating and updating your environment constantly. The following aspect are crucial to your continuous improvement and therefore for the profitability of your trading algos:

Dashboards with P&L and execution KPIs are mandatory for any automatic trading algo or your manual execution

Efficient backtesting of newly developed trading strategies is essential: inaccuracies in new strategies can create unexpected losses

Professional trading tools will support you reliably to ensure that your exchange interfaces and strategies get updated in time

How mature is the continuous trade monitoring of your execution – and how could it be better?

Speed up your algo development!

Do you want your algorithmic power trading to beat the market? The last element of our series on the digital transformation of energy trading, will examine ALGORITHM DEVELOPMENT.

Markets are changing and opportunities are moving within markets. Growth of renewables, sector coupling, new business models, new regulations… who can say what strategies will be successful in a month, a year, in two years? To succeed you need to be able to quickly develop and deploy new algos, update existing ones and decommissioning former algorithms.

Stay ahead of the game by creating an architecture in which the development of new strategies becomes the rule, rather than an action of spare time

Ensure seamless integration of all of your tools – such as data management, execution and monitoring by using a professional execution management system and a well-designed architecture

How mature is your algo development – and how could it be better?

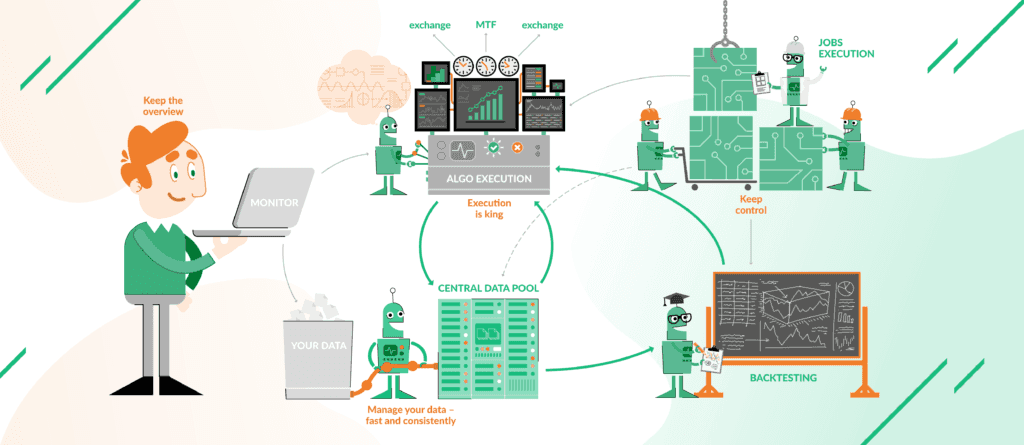

An integrated Robo landscape!

Gluing together all the pieces into one architecture is another challenge in itself! Here is your masterplan to an integrated Robo landscape in one picture!

Robo Shopping!

How do you make the right purchase decisions? In our series on the digital transformation of energy trading, we’ll talk about ALGOTRADER SELECTION.

In algorithmic trading, the ‘make or buy’ decision is still relevant, but vendor tools are now so highly developed and extensively tested that players find a ‘make’ decision increasingly hard to justify.

So, once you have decided to buy, the question is which solution it should be. Since there are many tools suitable for different situations and markets, you may be faced with a tough decision.

There is a lot to consider such as the scope of automation and how easily you can integrate with related systems. The support of continuous algo improvement is crucial, and speed and security cannot be overemphasized either.

Also, there are some commonsense rules.

Buying too cheap essentially means buying twice, and a careless choice may result in a roller-coaster implementation. Make sure to do a cost-benefit analysis too.

Should you need help with your selection, you can always get in touch with an expert who knows the algotrading landscape.

What algorithmic trading maturity level does your new algotrader need to support?

Train your Robo!

Once your algorithms are running, do you just sit back and relax? We advise against it and explain in the latest post of our series on the digital transformation of energy trading why TRAINING your robo trader is so important.

As a trader, you intuitively adjust your strategies all the time in response to market changes, and this is needed in algorithmic trading as well.

But because you’re delegating execution decisions to your robo trader, you have to teach it what you know by translating your strategy into rules implemented in code. And as the market changes, you have to continue training it, updating your strategies to keep up with the changing market.

This requires a structured process, so that your algo can safely take changes in strategy live on the market.

Once you have a suitable data management, development and test environment in place, be sure to …

Follow and analyze market and other relevant data with charting and trading tools such as watchlists,

Time & Sales (T & S) and Depth of Market (DOM)Identify potential trading signals and convert these into rules the algo can follow

Backtest to make sure the algo works as expected

Continuously monitor algo performance

It’s a circular sequence, so you need an organized system that allows for repeatability.

Train your robo constantly to keep up with the competition, or better still to be ahead of the game.

How mature is your robo training system – and how could it be improved?

Speed up your Robo!

When the Deep Blue AI beat Garri Kasparov in a game of chess in 1996, it did so by calculating an average of 126 million positions per second.

AI machines are designed to find the most efficient outcomes and process all the if/then scenarios that would simply overwhelm humans.

Trading is not so far off from chess; in our series on the digital transformation of energy trading we now look at the need for SPEED for creating a competitive advantage.

Recent developments in computing allowed algo traders to become so incredibly fast that a majority of companies already rely on it.

That is because power markets in particular show an increased demand for speed, especially in liquid parts of the market. With gas markets on the rise at the moment, liquidity will become key in gas trading and will further drive the demand for speed.

In trading, being too slow basically means being quickly out of money. In the energy market, this is causing manual traders to leave the race, since now automated trading solutions find the right opportunities and trade before anybody else can.

However, an algo that competes in the leading field doesn’t come for free and is sometimes hard to come by. Many companies rely on algo trading experts that bring them up to speed with an automated solution for an optimized result in trading. Checkmate.

How fast is your algo – and how fast should it be?

Secure your Robo!

Well, you have come quite far in your algotrading journey … so far.

Your trading portfolio is deep in the profit zone, but … “what if” …

To be prepared for all eventualities, each aspect of your automation and algorithmic trading routine needs to be secured thoroughly. If you haven’t done that yet, you might want to consider a holistic safety approach to ensure resilience in the face of errors and interruptions:

Have you identified the boundaries of what the algo should be allowed to do, and put checks and limits in place to prevent undesirable trades?

Have you thought of sources for interruptions and are you prepared for them?

Have you investigated the probabilities of your outage scenarios?

Are the costs of interruptions known?

Remember, one bad trade or one outage can easily eliminate all of your harvested profits. You have come so far … time to put a safety net into place.