05.10.2021 / 09:38

Recap IBOR

Financial Markets

LIBOR Series (Part 1)

“The European Commission, ECB Banking Supervision, EBA and ESMA encourage market participants to cease all LIBOR settings”.

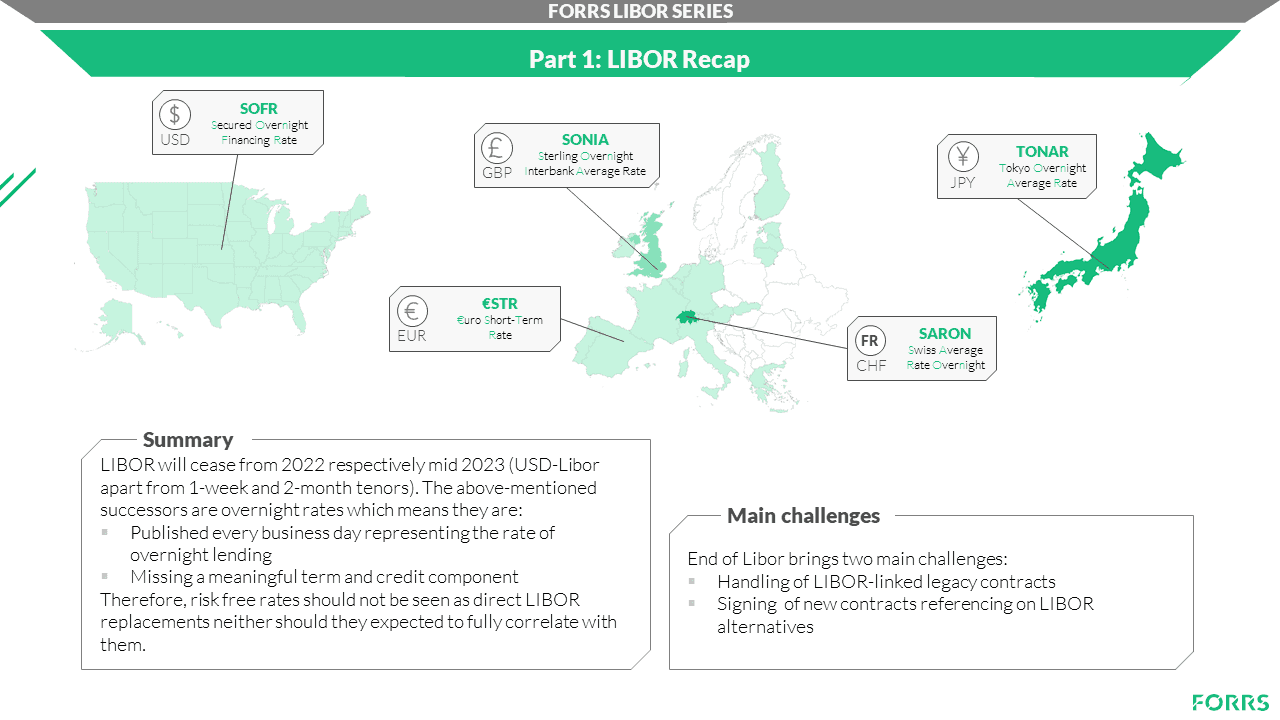

The die has been cast: EUR-, GBP-, CHF- and JPY-LIBORs as well as the 1-week- and the 2-month-USD-LIBOR will retire in 2022 being followed by the remaining USD tenors in June 2023. If financial institutions plan to significantly decrease LIBOR exposure until these due dates, they are facing two major challenges – decreasing existing exposure as well as avoiding future exposure.

The first one, existing exposure in LIBOR linked contracts, which are maturing after these deadlines can be handled by existing ISDA fallback protocols if applicable. A second solution to this can be found in bilateral negotiations but unfortunately, turn out to be extremely time consuming and therefore very pricy. But still, there might be some “tough legacy” contracts caused by jurisdictional issues that cannot simply be converted from LIBOR to a new reference rate.

To solve the second of the above-mentioned problems financial institutions should avoid LIBOR as a reference rate in new business. Regulators such as NY FED, Bank of England, European Central Bank, etc. suggest using the currency-specific Risk-Free Rate – €STR for Euro, SONIA for GBP, SARON for CHF, TONAR for JPY or SOFR for USD contracts instead of the respective LIBOR. These are risk-free overnight rates published every business day representing the cost of overnight lending and therefore lack a meaningful term and credit component. Nevertheless, these term and credit components are crucial for some products.

As a result, existing information providers are launching alternatives to risk-free rates, the most advanced so far are those for USD SOFR.

To prove this is highly interesting here are some examples of newly published alternatives:

The ICE created the so-called Bank Yield Index, Bloomberg started the Bloomberg Short-Term Bank Yield Index (BSBY). IHS Markit offers not only the USD Credit Inclusive Term Rate but even a spread adjustment rate (Credit Inclusive Term Spread) which is also used as an add-on to SOFR. Last but not least the Ameribor owned by the American Financial Exchange is worth mentioning.

Future might show whether these rates will ever be used heavily and gain market relevance.