16.06.2023 / 09:50

The Collapse of Silicon Valley Bank

Financial Markets

On the afternoon of Wednesday 8 March 2023, after market closure in the U.S., SVB Financial Group, also known as Silicon Valley Bank (SVB), announced the sale of its available-for-sale securities at a loss of $2,5 billion along with a share sale, seeking to raise $2,25 billion in liquidity. This spooked depositors and investors sending shock waves through financial markets with SVB’s stock price plummeting over 60% on Thursday 9 March.

In the US, deposits up to $250 000 are insured by the federal government. Due to SVB’s densely networked and high-value customer base however, a significant majority (approx. 93%) of the bank’s deposit base was above $250 000 and therefore, uninsured. As a result, several prominent venture capital firms concerned about SVB’s solvency advised their portfolio companies to move their deposits. Word spread rapidly, and within record time, depositors were rushing to withdraw their deposits.

It was the first major bank-run of the digital age, with investors withdrawing $42 billion in deposits from the Bank on 9 March 2023. At the close of business on 9 March, despite attempts from the bank to transfer collateral from various sources, the bank had a negative balance of $958 million and was incapable of paying obligations as they came due, rendering it insolvent. On 10 March the bank was closed by the California Department of Financial Protection and Innovation making SVB the second biggest bank failure in US history (after Washington Mutual in 2008).

This article provides an overview of some of the reasons for the collapse of SVB along with some key takeaways.

A Tripling of the Balance Sheet

Silicon Valley Bank was primarily focused on serving the tech ecosystem within the San Francisco Bay area. SVB offered tech startups a range of services including deposits, loans, cash management and investment products. Throughout the tech investing boom, a surge in venture capital funding led to a substantial increase in the available funds of SVB’s clients, especially in the years 2019-2021. This growth is reflected in the bank's total deposits more than tripling from the end of 2019 ($61,8 billion) to the end of 2021 ($189,2 billion). The total balance sheet likewise tripled during the same period from $71 billion to $221,3 billion.

How Were These Deposits Invested?

The Global Financial Crisis (GFC) of 2008-2009 revealed weaknesses in the banking system, particularly in terms of liquidity risk management. Under the third Basel Accord (Basel III), regulators introduced a requirement for banks called the Liquidity Coverage Ratio (LCR) to ensure that banks have enough liquid assets to cover their short-term funding needs. The LCR requires banks to hold a sufficient amount of high-quality liquid assets (HQLA) that can be easily converted into cash with little loss of value to meet their net cash outflows over a 30-day period during a severe stress scenario.

Accordingly, a large percentage of deposits received by SVB were placed in high-quality securities, mostly Treasury securities and agency-issued mortgaged-backed securities, at various maturities. SVB followed a two-pronged approach: shorter duration available for sale (AFS) and longer duration higher yield held-to-maturity (HTM). The classification determines how these assets are accounted for and impacts their valuation. HTM assets are recorded at amortized cost and are not subject to market fluctuations, providing stability to the bank's balance sheet. On the other hand, AFS assets are marked-to-market, making their valuation more sensitive to market volatility, which may impact the bank's capital base. Thus, banks must carefully weigh the trade-offs between stability and potential volatility when deciding how to classify their securities.

From 2019, the majority of growth took place in the HTM book, which grew from $13,8 billion in 2019 to $98,2 billion in 2021 – by contrast, the AFS book (only) doubled during the same period growing from $14 billion (2019) to $27, 2 billion (2021). The bulk of these investments were made when interest rates were exceptionally low.

Rising Interest Rates and Falling Asset Values

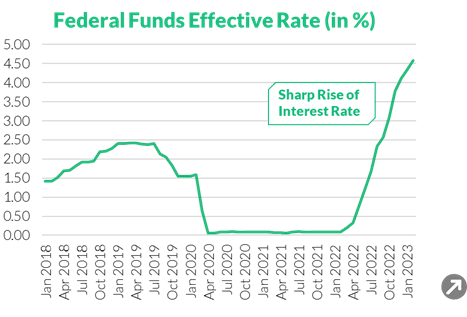

During 2021, the belief from the Federal Reserve (Fed) was that the rapidly increasing inflation observed in the wake of the Covid-19 reopening was transitory. Accordingly, interest rates remained low and bond yields were high. In 2022 however, the Fed pivoted away from the transitory inflation narrative and rapidly started increasing the federal funds rate. Indeed, 2022 saw the fastest increase in the federal funds rate on record, resulting in long-dated treasuries suffering historic losses. If held to maturity however, such losses remain unrealized.

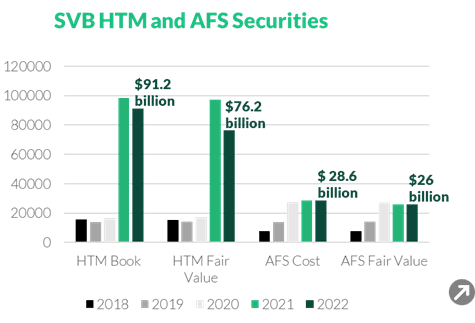

From SVB’s balance sheets, the signs of trouble were evident, as shown in Figure 1 below:

The AFS book with a fair value of $26 billion and a cost of $28,6 billion – implying that the bank was underwater on some of these securities.

Likewise, the HTM book was at $91,2, with a fair value of $76,2 billion.

Figure 1: Federal Funds Rate (left) and the SVB AFS and HTM books (right) 2018-2022

Throughout 2022, deposits at SVB started falling from $189,2 billion in December 2021 to $173,1 billion by the end of 2022. This is likely reflective of a system-wide contraction. The primary reasons for this contraction may include:

With rising interest rates and the associated drop in tech company valuations, venture capital funding became less forthcoming for the burgeoning, if typically unprofitable, tech startups. To cover expenditures, these companies started withdrawing bank deposits.

Alternative secure investments, for example treasure bills, started offering higher yields than bank deposits due to increased interest rates.

To avoid taking a loss on the sale of underwater securities to cover the outflow of $16 billion of deposits, SVB took on short-term debt of $13,6 billion in 2022. This ultimately proved insufficient to cover deposit outflows, causing SVB to sell $21 billion of its AFS portfolio at an after-tax loss of approximately $1.8 billion. SVB was unable to tap into its HTM portfolio – which would then be marked-to-market, resulting in a loss that the bank could not absorb. Hence a capital raise was needed – the announcement of which, along with the sale of AFS securities and associated losses, lead to the collapse of SVB.

Some Lingering Questions and Key Takeaways

A detailed analysis of the broader macroeconomic factors that led to the failure of SVB, and the implications thereof is beyond the scope of this article. There are however a few lingering questions and concerns that readers should take note of:

Why was SVB forced to take the loss by selling its AFS securities?

Banks facing a withdrawal shortfall have several potential options available to them (apart from selling securities at a massive loss). Such options, most notably, include the Federal Reserve’s 90-day short-term emergency loan facility - the discount window. The use of the discount window had been rising throughout the second half of 2022 - following the failure of SVB, banks borrowed a record $152,85 billion from the Fed. Following the collapse of SVB, the Fed created a new loan facility, the Bank Term Funding Programme (BTFP), which allows banks to take out longer-term loans (for up to one-year) where government bonds are valued as collateral at full face value (i.e. no haircut, as would be the case when using the normal Fed discount window).

Interbank lending facilities and the REPO market is another option for securing funding to cover deposit outflow. A further option could have been the securitization and sale of bank loans– though it should be noted such securitization is time-consuming and might be impractical in the short-term. SVB’s failure to execute an alternative approach to addressing a shortfall may be indicative of broader systemic liquidity or credit issues.

Why did SVB not hedge against rising interest rates?

SVB’s risk management practices have been widely criticized by analysts and in the media – particularly SVB’s failure to hedge against interest rate risk throughout 2022. A common instrument that might have been used to hedge such risk is an interest rate swap, which is a contract between two parties where one party agrees to pay a fixed interest rate to the other party, while the other party agrees to pay a variable interest rate based on a reference rate. It should be noted that in December 2021, SVB did have $10,7 billion in interest rate swaps, indicating a voluntary reduction in hedges.

In conclusion, the collapse of Silicon Valley Bank in March 2023 was triggered by a combination of factors. Externally, the rapidly rising interest rates hit SVB’s customer base particularly hard leading to a decline in deposits and losses on long-term investments. Internally, SVB investments into longer-dated, higher-yield securities without suitable hedging are highly questionable. This event highlights the importance of prudent risk and liquidity management and careful consideration of risk-reward trade-offs in investment decisions.