14.02.2024 / 13:30

The Illusive Price of Green Hydrogen: Price Transparency and EEX HYDRIX

Energy Markets

In this latest article in our ongoing series on the #HydrogenEconomy, we take a closer look at the transparency of hydrogen prices, and the importance of price indices in providing the market with such price transparency. How is the price of a commodity product such as hydrogen determined? Is it what the customer is willing to pay? Is it what the supplier demands? Is it the invisible hand of the market?

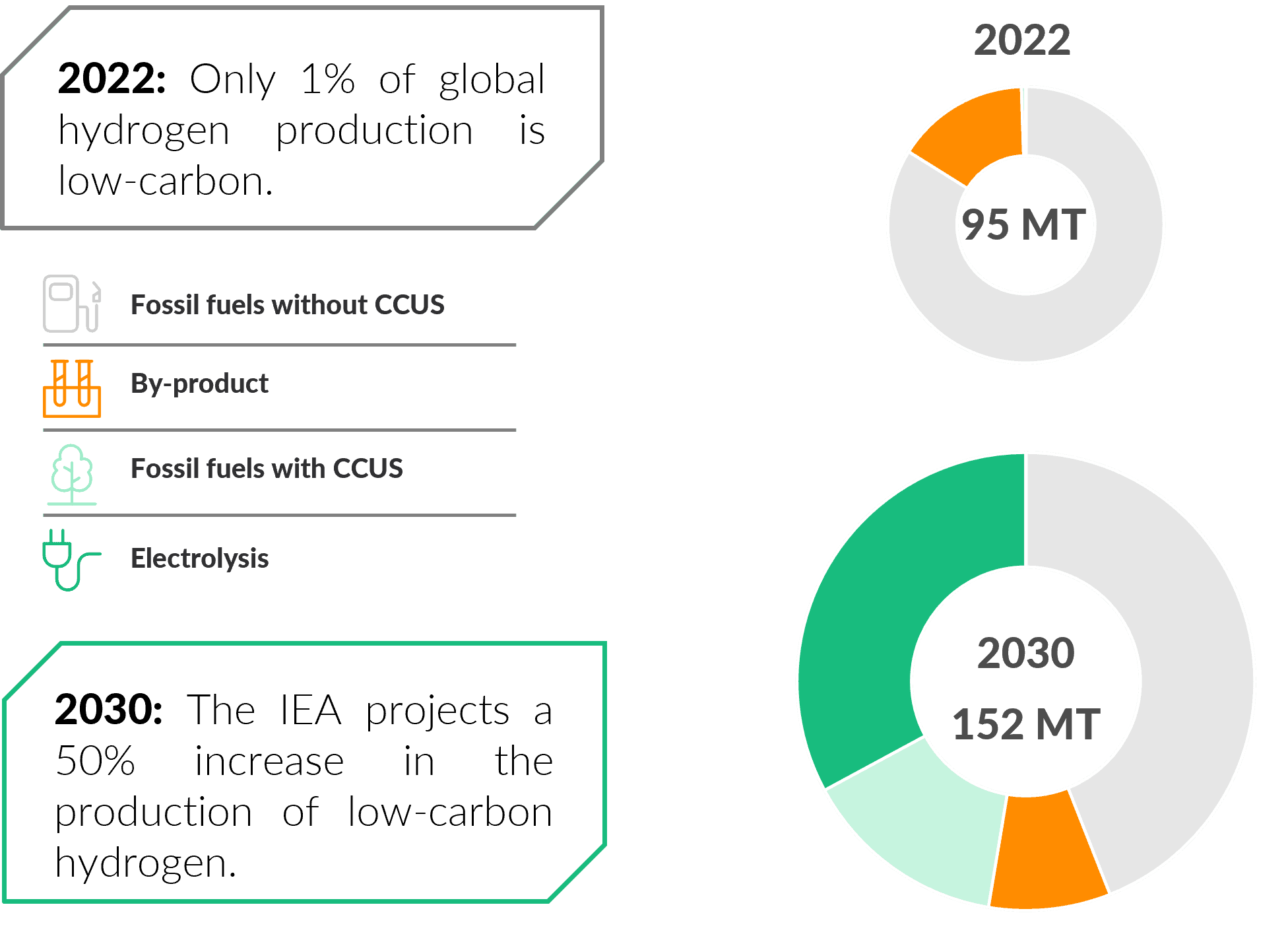

As has been discussed in an earlier article in our ongoing series, the #HydrogenEconomy is still very much in the early phases of its development. As seen in Figure 1, grey hydrogen, mostly produced through steam methane reform (SMR), remains the dominant mode of hydrogen production. End users are typically dependent on single suppliers, or indeed produce their own hydrogen on-site, often as a by-product from producing another core product. The market for green hydrogen remains marginal constituting about 1% of global hydrogen consumption and about 2% of consumption in Germany. Strong growth is however projected in the #HydrogenEconomy where, by 2030, it is estimated by the IEA that low-carbon hydrogen (i.e. hydrogen produced through electrolysis or using carbon capture and storage), will account for approximately 50% of consumption.

Figure 1: Current (2022) and projected (2030) states of hydrogen production by volume and technology (IEA, 2022)

The Value of Hydrogen Price Transparency

Due to the low volumes of traded hydrogen, along with minimal supply and demand, there exists no broad hydrogen trading market. Hydrogen prices are primarily set in bilateral transactions whereby hydrogen producers and project developers must identify potential off-takers on a case-by-base basis. As such, both the current and prospective market participants lack transparency in terms of current and historic pricing for both green and grey hydrogen. Clear price signals are however requisite for market development and facilitation of investment decisions. Indeed, the establishment of hydrogen price indices is central to providing such transparency, promoting efficient transactions, providing reliable cost indications and enabling hedging and risk management.

In seeking to address issues of price transparency, several hydrogen price indices have been created. Examples include the S&P Global Commodity Insight which estimates production costs of hydrogen through SMR, and E-Bridge’s Hydex and HydexPlus indices, which are based on the estimated marginal costs of grey, blue and green hydrogen production. Though these indices are an important step towards providing market participants with a level of price transparency, it should be noted that the depicted prices do not include capital, transport and distribution costs which are reflected in the final price paid by consumers.

Market-Based Hydrogen Pricing – EEX HYDRIX

EEX HYDRIX is the first – and currently the only - market-based index for green hydrogen. Green hydrogen is, in this instance, defined as hydrogen produced through electrolysis powered by renewable energy. HYDRIX shows the price reported by producers and consumers of green hydrogen based in Germany, for one MWh of green hydrogen, thereby reflecting both the supply and the demand sides of the market. As such, the various factors contributing to the price paid – over and above production costs – are implicitly included. Such factors may include transportation and distribution costs, capital costs and subsidies.

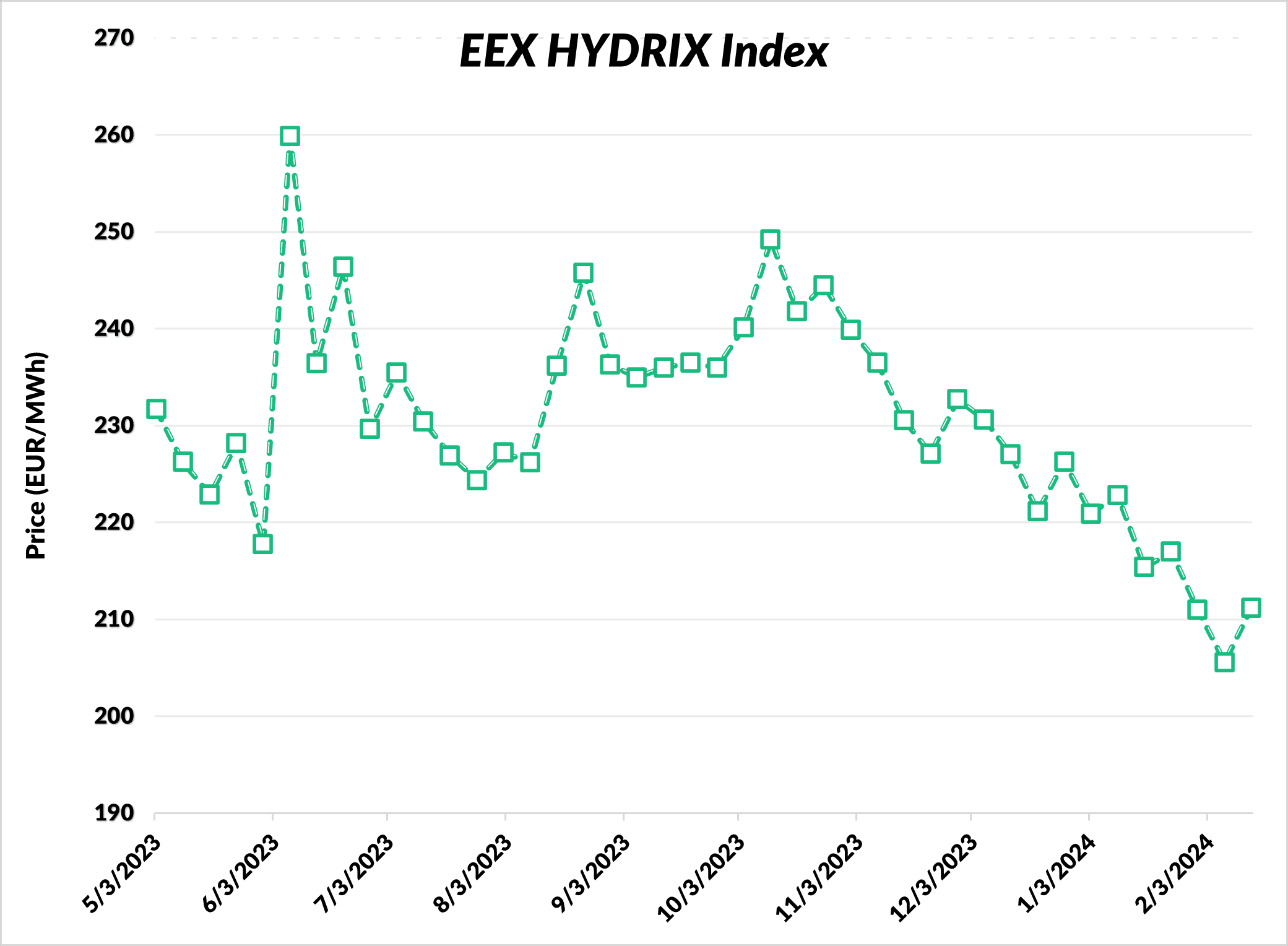

HYDRIX is compiled on a weekly basis in collaboration with several established industry partners including utilities, trading houses, engineering companies, industrial consumers and green hydrogen producers. The price is provided in EUR/MWh, so as to be comparable to natural gas. For the conversion of mass to energy, the lower heating value of 33.33 kWh/kg or 3.00 kWh/Nm³ is used. The index price is further calculated as the unweighted arithmetic mean of values provided by contributors. Unweighted in this context means that volumes are not included in the calculation. Since its launch in May 2023, HYDRIX hydrogen prices have fluctuated between approximately 205-260 EUR/MWh, as seen in Figure 2 below.

Figure 2: EEX HYDRIX price development (May 23 – Feb 24)

The EEX-Hintco Collaboration for Green Hydrogen

EEX recently signed a Letter of Intent with Hintco, a Leipzig-based subsidiary of the H2Global Foundation, to conduct auctions for renewable hydrogen and its derivatives like ammonia, methanol, and aviation fuel. The platform is expected to facilitate the market launch of renewable hydrogen in a cost-efficient manner. The collaboration seeks to establish a liquid market with strong price signals for renewable hydrogen, contributing to the modernization and decarbonization of industries. The H2Global instrument, implemented by Hintco, involves competitive bidding processes for long-term purchase agreements, providing investment security for producers. This hydrogen platform will initially be situated outside of the regulated exchange, which allows for greater flexibility and responsiveness to the rapidly developing hydrogen sector. It is envisioned that once it achieves a certain level of maturity and stability, it could be integrated with the regulated part of the exchange. EEX’s experience in energy trading is hence leveraged to increase liquidity in the renewable hydrogen market, with the first auctions anticipated by the end of 2024.

Expanding Horizons: The Future of HYDRIX and Beyond

As mentioned, HYDRIX currently provides the price of green hydrogen in Germany. It is the goal of the EEX to significantly expand HYDRIX. Such an expansion could include extended market areas, different colours of hydrogen (e.g. grey, blue) and hydrogen derivatives (e.g. ammonia, methanol). However, the ultimate aim of EEX, as the world’s largest energy exchange is not just the creation of an index - rather EEX aims to realize a regulated exchange for the trading of hydrogen and its derivatives.

Conclusion

In conclusion, as the hydrogen economy progresses, the transparency of hydrogen prices emerges as a pivotal factor in shaping the market dynamics. The absence of a widespread hydrogen trading market, coupled with bilateral transactions dominating the sector, underscores the need for reliable price information. The development of hydrogen price indices represents a positive step toward providing market participants with essential price transparency. Such indices are however typically based on the projected costs of hydrogen production rather than what is physically paid by off-takers. EEX HYDRIX is the first market-based index for green hydrogen based on offtake payments – thereby implicitly incorporating transportation and distribution costs.

Moving forward, refining and expanding such indices will be essential for fostering efficient transactions. Furthermore, the collaboration between EEX and Hintco, aiming to launch auctions by 2024, underscores efforts to create a liquid market, providing investment security for renewable hydrogen producers and advancing the transition to a more sustainable and low carbon hydrogen economy.