25.05.2021 / 09:12

FORRS Maturity Model: Is your organization ready for the next level of trading automation? Smart Execution Strategies!

Energy Markets

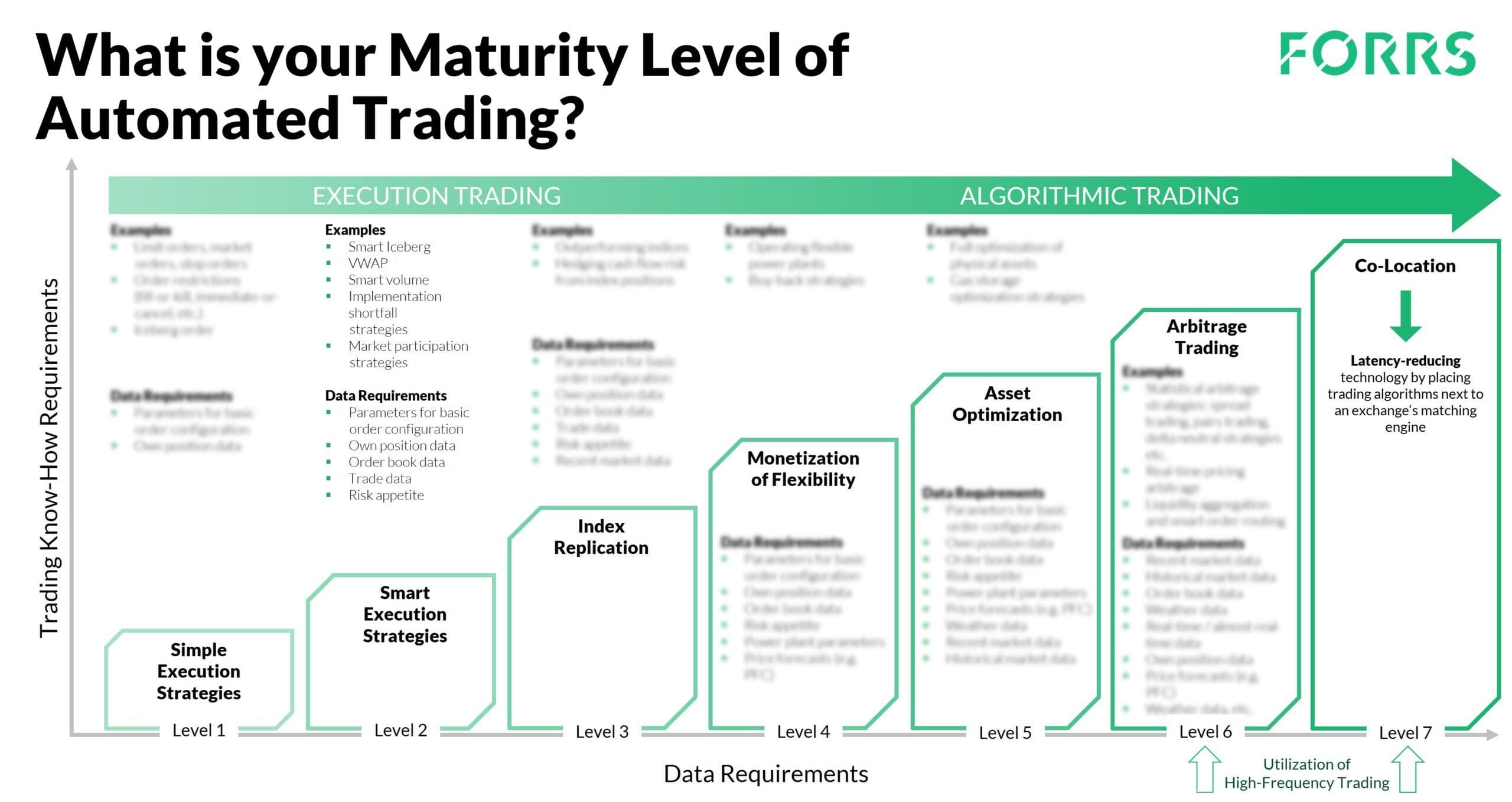

The FORRS Maturity Model

The FORRS Maturity Model helps your organization find the right maturity level of automated trading strategies. Level 2, Smart Execution Strategies represents the first major level of automated trading.

Although some market players execute their positions with a smart execution strategy, many trading organizations today are still executing positions manually, for gas as well as power. On the power spot markets EPEX SPOT and Nord Pool, over 60% of all orders are placed via their APIs – in other words, through automation.

Smart execution strategies are essential today. They help you place your buy or sell orders most efficiently in the order book to get the best prices. A smart execution strategy can be outperforming a volume-weighted average price or a smart iceberg strategy. Of course, optimized and customized to the specific needs of the particular trading desk.

Generally speaking, no manual trader is quicker and at the end more profitable in a long run than a smart execution strategy. For many organizations, such a strategy can also replace a big part of their 24/7 shift trading, while at the same time freeing traders to focus on more strategic, higher value activities, like improving existing trading strategies or developing new ones.

However, it’s not enough just to write smarter algorithms; establishing execution strategies requires an investment in the internal system and process landscape. For example, regulatory authorities might require maintaining a highly resilient technical infrastructure. Meanwhile risk control and operational capabilities must enable an organization to avoid placing erroneous orders and must protect against entire strategy malfunctions. And last but not least, managing data well and ideally centralized is a crucial capability for trading automation, for example to perform Backtesting of smart execution strategies efficiently and correctly.

Is your organization ready for the next level of trading automation? Whether you decide to fully develop and build your own smart execution strategy or to seek a third-party provider for automated trading, you don’t have to do it alone.

FORRS has a proven track record of helping organizations to implement and improve the systems they need for automated trading. Our Maturity Model allows us to create a roadmap for automation tailored to your specific needs.

Visit our website to learn more: www.forrs.de. Or contact me today on LinkedIn to discuss next steps together: Martin Hiller.

Read more about the first and third level of the FORRS Maturity Model. Check out more news and interesting articles in the FORRSight news.