07.08.2019 / 13:58

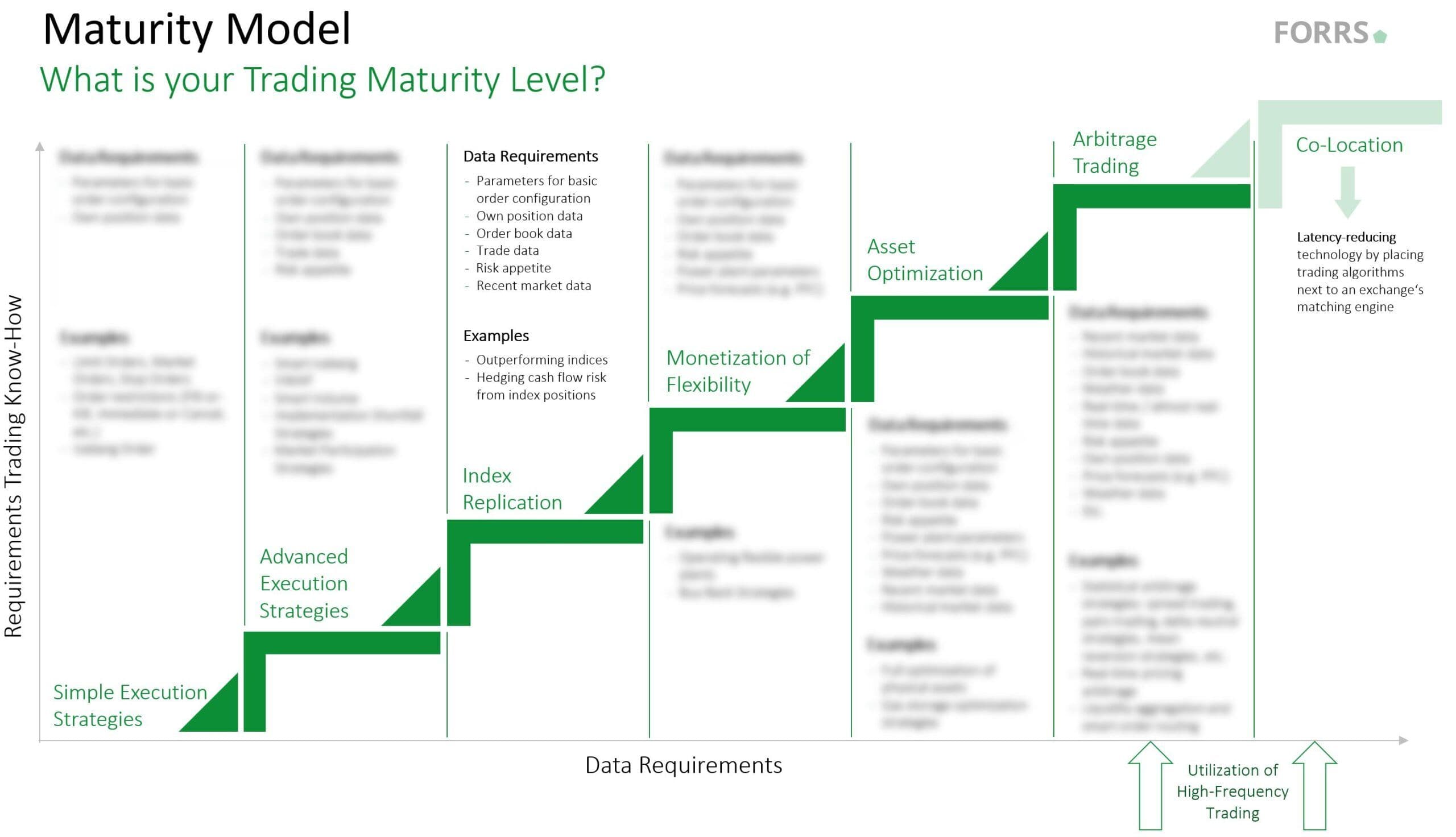

FORRS Maturity Model: Learn how our proven Model can help you gaining additional profit from commodity index replication – by getting the most out of automated trading strategies.

Energy Markets

The FORRS Maturity Model helps your organization find its right maturity level of automated trading strategies. Level 3 of our Maturity Model explains how to replicate and outperform commodity indices by using automated energy trading.

Commodity indices are a common way to reduce price risk in wholesale commodity trading. Instead of agreeing on a fixed price for the exchange of a certain commodity, such as natural gas, counterparties agree on a price that’s indexed to daily-published market prices, such as closing prices of natural gas futures contracts. This reduces market risk, but at the same time increases cash-flow risk, which can affect your trading department as well.

Some trading departments transfer this cash-flow risk to banks or other market players by swapping the unknown index price, leaving them with neither cash-flow risk nor market risk. At the same time, they pay a margin to the counterpart for eliminating risk.

Why not keep this margin – while simultaneously replicating and even outperforming the index price?

You can now achieve this performance by utilizing automated trading in power and gas short-term trading on energy exchanges like EPEX or PEGAS; for example, in day-ahead or intraday markets for gas or in the power intraday market. Depending on your exposure towards the index price, prices in the order book below or above the agreed index price act as a buy or sell signal.

Getting to this point requires a fast and highly efficient data household, with operationally optimized and automated processes. Still, after creating the signal, a complex process must be carried out. The buy or sell signal must be translated into an order which is then placed and executed in order books of markets – quicker and more efficiently than others can do it. This cannot be conducted manually.

The good news is that automated trading software with strong and mature capabilities already exists in today’s market. Those automated trading facilities place and execute orders with high speed, while providing a flexible framework for implementing customized strategies, including the index replication strategy from above. Furthermore, these facilities provide a backtesting framework to test strategies based on historical order book data. This whole framework enables you to gain and maintain a competitive edge.

Building index replication strategies requires profound expertise across many dimensions – data supply and data management, deep understanding of energy markets on order book level, and coding strategies into algorithms, to name a few. This where our proven Maturity Model creates value immediately.

On Level 3 of our Maturity Model, we derive recommendations for customized index replication strategies and for an appropriate trading architecture, based on your individual trading and data requirements. We help you increase your ability to actively participate in markets, instead of merely reacting to market situations.

Take advantage of our long experience in automated and algorithmic trading and learn which level of the FORRS Maturity Model is most suitable for you.